SeAH Besteel follows in footsteps of Posco with shift to holding company Special steel maker’s stock price falls 14% after announcement on Thursday

Translated by Ryu Ho-joung 공개 2022-01-25 08:14:47

이 기사는 2022년 01월 25일 08:11 thebell 에 표출된 기사입니다.

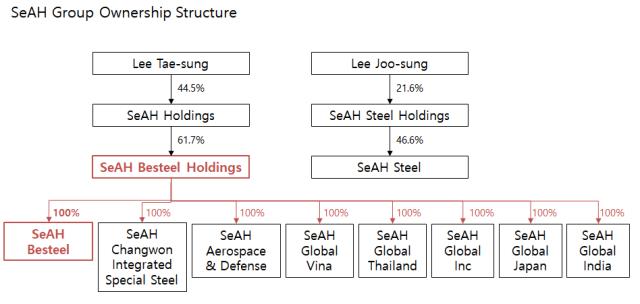

SeAH Besteel, a South Korean special steel manufacturer, announced a shift to a holding company on January 20, following in the footsteps of Posco, the country’s largest steelmaker.SeAH Group has two holding companies, SeAH Holdings and SeAH Steel Holdings. They are led by Lee Tae-sung and Lee Joo-sung respectively who are cousins and the grandsons of the steel conglomerate’s founder Lee Jong-deok.

Under a split-off plan, SeAH Besteel, a subsidiary of SeAH Holdings, will become an intermediate holding company – tentatively called SeAH Besteel Holdings – that will own 100% of a newly-created special steel business entity. A group of subsidiaries currently held by SeAH Besteel will also be placed under SeAH Besteel Holdings.

SeAH Besteel has promised not to list the newly-created business entity’s shares on the stock market in order to ease shareholder concerns about a dilution of shareholder value, saying that it was not considering an initial public offering of its mainstay special steel unit.

This mirrors a similar move by Posco, which made it clear that it would not take its steel business public unless its shareholders approves the listing by adding such provisions to the holding company’s articles of association.

SeAH Besteel and Posco are the latest of South Korean companies that split off their core businesses to turn them into their wholly owned subsidiaries. SK On and LG Energy Solution, the battery units separated from SK Innovation and LG Chem respectively, are preparing to go public, sparking criticism that such moves are causing harm to the parent companies’ shareholders.

Unlike Posco, which has a dispersed ownership structure, a roughly 62% stake in SeAH Besteel is owned by SeAH Holdings, with one-third of its total shares in the hands of minority shareholders. This is expected to help SeAH Besteel obtain the necessary support to transform to a holding company system more easily than Posco.

However, SeAH Besteel shares closed at 14,950 won ($12.53) on Thursday, down nearly 14%, reflecting investor concerns over the split-off of the business entity.

SeAH Besteel plans to seek shareholder approval for the split-off plan at its annual general meeting scheduled for March 25. If approved, the new special steel business entity will be launched on April 1.

Posco’s proposal to shift to a holding company will be voted on at an extraordinary shareholders meeting slated for January 28. Both Posco and SeAH Besteel have emphasized that they would step up efforts to improve their governance to become more “board-centric”.

According to SeAH Besteel, SeAH Besteel Holdings will add three more committees – the ESG (Environmental, Social and Governance) Committee, the Ethics and Compliance Committee and the Compensation Committee – to two existing committees, which are the nomination and auditing committees, within its board.

Posco also said the ESG committee would be established within the board of the newly-created steel business entity. (Reporting by Seo-young Kim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [Peer Match Up/정유 4사]신사업에 사활 건 정유사, '같은 듯 다른' 미래 방향성

- [LG화학의 변신]'LG엔솔 덕' 잘 나가는 전지소재

- [방산기업 국산화율 톺아보기]K방산 이끈 '한국형 프로젝트'

- [한경협 파이낸셜 리포트]국정농단 이후 회원사 미공개, 자신감 회복 언제쯤

- 시노펙스, 옌퐁사업장 IATF16949 인증 획득

- [PB센터 풍향계]현대차증권 첫 VIP센터, 자체 랩 라인업 완성

- OCIO에 눈돌리는 창투사…시장 활황 이끌까

- [운용사 실적 분석]제이씨에셋운용, 운용보수 보다 많은 평가익 '눈길'

- 키움증권 퇴직연금 사업 나선다

- [thebell interview]"발품으로 만든 투자 기회, 고객 수익 극대화에 올인"