Kakao chair opts not to extend loans backed by his shares Kim Beom-su last year fully repaid debt he took out using Kakao shares as collateral

Translated by Ryu Ho-joung 공개 2022-01-26 08:04:46

이 기사는 2022년 01월 26일 08:03 thebell 에 표출된 기사입니다.

Kim Beom-su, founder and chairman of South Korean tech giant Kakao Corp, last year dropped a pledge of shares as collateral against a personal loan, a move seen as part of efforts to keep a low profile following the controversy over Kakao’s affiliates and his personal company K Cube Holdings.In November last year, Kim repaid a 50 billion won ($41.8 million) loan he took out using his 1.49 million shares in Kakao as collateral at an interest rate of 2.29%, fully unwinding a pledge of the company’s shares against his personal loan, according to industry sources.

The Kakao chairman, who is the company’s largest shareholder, first pledged part of his shares to borrow 30 billion won from Samsung Securities in November 2016. The following year, he extended the loan and took out an additional 60 billion by pledging more of his shares.

Since then, Kim had continued to extend the maturity of those loans. However in May 2021, he opted to repay 40 billion won when it matured and also repaid the remaining 50 billion won six months later.

The move is seen as part of his efforts to avoid further controversy after Kakao’s affiliates were at the center of criticism a few months ago. Kakao Mobility’s service fee hike in August last year sparked concerns about its unrivaled dominance in the market, ending up with Kakao’s other key affiliates facing criticism over their aggressive expansion across industries at the expense of small business owners.

When Kim appeared before lawmakers during an annual inspection of the state administration in October, he apologized and promised to overhaul the governance of the group.

Some lawmakers at the time took issue with K Cube Holdings as well, saying that it had been Kakao’s de facto holding company and this could be a violation of the principle of “separation of industrial and financial capital”.

K Cube Holdings, which is wholly owned by Kim, is the second largest shareholder of Kakao with a roughly 10% stake. Notable is that the amount of a loan taken out by K Cube Holdings against its shares in Kakao also significantly reduced from 195 billion won to 50 billion won last fall.

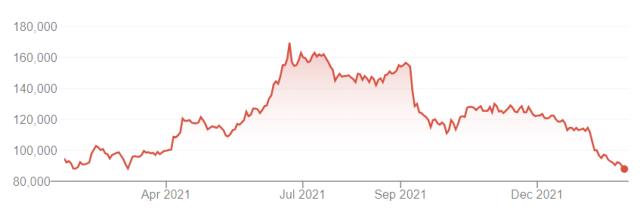

Kim’s unwinding a pledge of shares coincides with a plunge in the price of Kakao shares in recent months, which would have caused him to pledge more shares if he opted to extend the loans.

The value of Kim’s shares in Kakao has recently fallen to nearly 5.4 trillion won since hitting 9.6 trillion won in June last year as the share price of Kakao declined more than 30% in the past two months.

Kim previously pledged to donate more than half of his wealth to help solve social issues by joining the Giving Pledge campaign early last year. (Reporting by Seul-gi Kim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]인니 정부, 친기업 정책 드라이브에 뜨거운 관심 '체감'

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]"유망 스타트업 양성소, 글로벌 투자 거점 부상"

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]"철저히 투자금융 관점서 봐야, 전략적 접근시 유리"

- [2023 더벨 글로벌 투자 로드쇼-베트남]신용보증기금, 중기 베트남 진출 지원에 팔 걷었다

- [2023 더벨 글로벌 투자 로드쇼-베트남]인프라·산업 투자 증가, 부동산 가격 상승 견인

- [2023 더벨 글로벌 투자 로드쇼-베트남]떠오르는 신규 투자처 '온실가스 감축 프로젝트'

- [2023 더벨 글로벌 투자 로드쇼-베트남]VITASK, 베트남 현지 기업 생산·기술력 개선 앞장

- [2023 더벨 글로벌 투자 로드쇼-베트남]급성장 '핀테크' 산업, 전자 결제·P2P·초단기 분야 각광

- [2023 더벨 글로벌 투자 로드쇼-베트남]진출 계획시 세무 접근 필요, '우대세율·감면' 활용해야 '득'

- [2023 더벨 글로벌 투자 로드쇼-베트남]한국이 투자 주춤할 때 태국은 과감히 '베팅'