Why Iljin Materials is up for sale Sale plan comes after Iljin Group’s addition to Korean competition regulator’s watch list

Translated by Ryu Ho-joung 공개 2022-05-27 08:05:48

이 기사는 2022년 05월 27일 08:00 thebell 에 표출된 기사입니다.

Iljin Materials, the copper foil-making unit of South Korea’s Iljin Group, has been put up for sale, making many wonder why the family-controlled conglomerate wants to sell its cash-cow business.The sale plan comes after Iljin Group earlier this month was added to the Fair Trade Commission’s list of conglomerates whose group of businesses are collectively worth over 5 trillion won ($3.95 billion) in fair value. Those included in the list become subject to heavy scrutiny by the country’s competition regulator.

Many of the conglomerate’s affiliates have large dependence on intercompany transactions. ljin Diamond, which is 50.1% owned by Iljin Holdings, generated 41.6 billion won in revenue from intercompany transactions last year, which represented 67.5% of its total revenue. About half of the 2021 revenue made by Iljin Development, a wholly owned subsidiary of the holding company, also came from intercompany transactions.

An intercompany transaction was used for the group’s succession planning. In 2013, Iljin Group chairman Heo Jin-gyu sold his 15.3% stake in Iljin Holdings to Iljin Partners, which is wholly owned by his eldest son Heo Jung-seok. Iljin Partners funded the transaction with cash earned from transactions with Iljin Electric, a subsidiary of the holding company.

Some industry watchers had speculated that Iljin Group might want to spin off Iljin Materials and its subsidiaries as a whole – which are controlled by the chairman’s second son Heo Jae-myeong – letting his elder brother run Iljin Holdings and businesses under its belt.

However, in an unexpected move, the conglomerate opted to downsize itself by offloading Iljin Materials.

Iljin Group decided to sell the copper foil producer, probably because of a heavy investment burden, industry experts said. Copper foils are one of the key components used in battery electric vehicles. To keep abreast of the fast-growing electric car industry and expand their share in the market, battery materials companies are increasing investment at a rapid pace.

Iljin Materials spent 208.7 billion won on the acquisition of tangible assets in 2021, up 58% from 132 billion won in 2019. Rival SK Nexilis also increased such spending to 185.8 billion won in 2021 from 103 billion won in 2019.

SK Nexilis receives financial support from its parent company SKC. In contrast, Iljin Materials, which is directly owned by the Heo family, has financed capital spending through cash on hand, loans and external funding.

With the competition in the battery materials market getting intense, Iljin Group could have concluded that it is the right time to exit the copper foil business, especially given that the country’s large conglomerates with deep pockets, such as SK, LG and Posco, are pushing to grow their shares in the market.

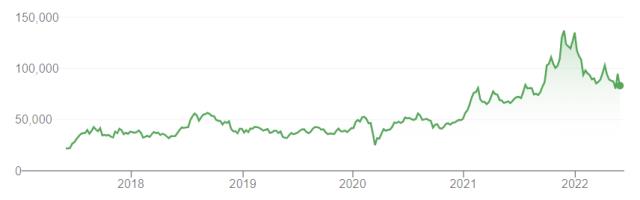

Iljin Materials shares jump nearly 90% in the last three years. Heo Jae-myeong, the company’s chief executive, is expected to secure more than 3 trillion won by selling his 53.3% stake. The sale proceeds are likely to be used for new businesses. (Reporting by Wie-su Kim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]인니 정부, 친기업 정책 드라이브에 뜨거운 관심 '체감'

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]"유망 스타트업 양성소, 글로벌 투자 거점 부상"

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]"철저히 투자금융 관점서 봐야, 전략적 접근시 유리"

- [2023 더벨 글로벌 투자 로드쇼-베트남]신용보증기금, 중기 베트남 진출 지원에 팔 걷었다

- [2023 더벨 글로벌 투자 로드쇼-베트남]인프라·산업 투자 증가, 부동산 가격 상승 견인

- [2023 더벨 글로벌 투자 로드쇼-베트남]떠오르는 신규 투자처 '온실가스 감축 프로젝트'

- [2023 더벨 글로벌 투자 로드쇼-베트남]VITASK, 베트남 현지 기업 생산·기술력 개선 앞장

- [2023 더벨 글로벌 투자 로드쇼-베트남]급성장 '핀테크' 산업, 전자 결제·P2P·초단기 분야 각광

- [2023 더벨 글로벌 투자 로드쇼-베트남]진출 계획시 세무 접근 필요, '우대세율·감면' 활용해야 '득'

- [2023 더벨 글로벌 투자 로드쇼-베트남]한국이 투자 주춤할 때 태국은 과감히 '베팅'