EU veto of Korean shipbuilders' merger leaves limited options for KDB State-run lender likely to be left with option to sell Daewoo to a domestic non-shipbuilder

Translated by Ryu Ho-joung 공개 2022-01-18 07:54:38

이 기사는 2022년 01월 18일 07:53 thebell 에 표출된 기사입니다.

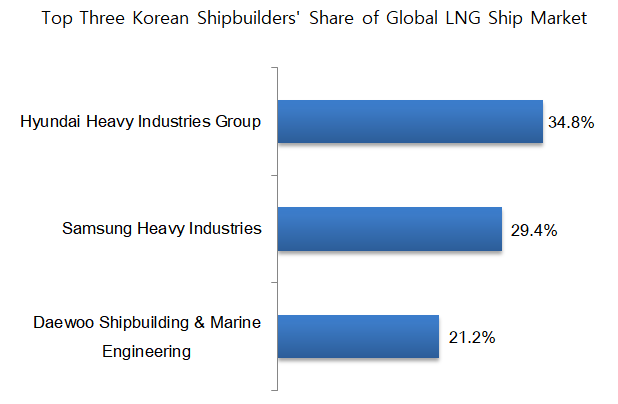

The EU’s veto of Hyundai Heavy Industries Group’s proposed takeover of Daewoo Shipbuilding & Marine Engineering is likely to leave limited options for the state-controlled Korea Development Bank (KDB), which is expected to continue its attempt to offload its majority stake in Daewoo Shipping amid the recovery of the shipbuilding industry.The European Commission said in a statement on January 13 that the deal would reduce competition in the global market for the construction of large liquefied gas (LNG) carriers. The two companies’ “combined market shares would be of at least 60%” and the merger would leave “very few alternatives for customers,” with the remaining shipbuilders unlikely to be able to constrain price increases, the statement said.

Apart from Hyundai Heavy Industries and Daewoo Shipping, another South Korean shipbuilder Samsung Heavy Industries holds a nearly 30% share in the global LNG carrier market.

However, the EU antitrust enforcer said this player “would not have been sufficient to act as a credible constraint on the new company resulting from the merger”.

This means it is very much likely that the EU would not give the green light either for a hypothetical merger between Samsung Heavy and Daewoo Shipping. Their combined market share would be around 50%, which is less than that for the merger with Hyundai Heavy. But the EU’s competition concerns would remain as Samsung Heavy and Daewoo Shipping are still two of the three largest players in the market.

“Given that the three South Korean players hold a combined market share of nearly 90% in the construction of LNG carriers, any merger between them is unlikely to obtain antitrust regulatory clearance,” an industry expert said.

New pool of potential buyers

The EU said that a fourth largest shipbuilder in the LNG carrier market had limited activities and so did the remaining shipbuilders as they received no LNG ship orders in recent years. It was apparently referring to Chinese and Japanese shipbuilders, which suggests the possibility that the competition watchdog may green light a potential takeover of Daewoo Shipping by its competitors in China or Japan.

However, it is very unlikely that KDB will sell its majority stake in Daewoo Shipping to a foreign shipbuilder.

When a consortium led by a Russian company sought to acquire Daewoo Shipping in 2013, KDB made it clear that the lender was not considering selling its stake to a foreign firm, citing the shipbuilder’s technology to build submarines as a reason.

This narrows the pool of potential buyers for Daewoo Shipping to domestic companies that are not from the shipbuilding industry, with some observers mentioning Posco and Hanwha as potential fits for the company.

However, both of the two conglomerates seem busy enough at the moment. Posco is in the process of shifting to a holding company structure, while Hanwha is stepping up efforts to transform its business focus to clean energy.

“With a strong recovery in orders, the South Korean shipbuilding industry has bought time to address structural problems that hurt profitability,” another industry expert said. “It is unlikely that (KDB) will restart a process to find a new buyer for Daewoo Shipping anytime soon.” (Reporting by Doung Yang)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

- EU antitrust watchdog worried about market power of Korean shipbuilders

- Korean shipbuilding consolidation deal may collapse as EU is unlikely to give nod

- Growing credit risk for Daewoo Shipbuilding amid acquisition delay

- Lengthy antitrust review complicates Hyundai Heavy’s Daewoo Shipbuilding takeover

best clicks

최신뉴스 in 전체기사

-

- 스튜디오산타클로스ENT, 주주권익 보호 '구슬땀'

- 이에이트, AI 시뮬레이션·디지털 트윈 기술 선보여

- MBK, '몸값 2조' 지오영 인수 SPA 체결 임박

- [2024 더벨 글로벌 투자 로드쇼-베트남]한인이 설립한 RCE, 세계 첫 ‘중장비 온라인 중고거래’

- 회계법인 해솔, 부동산 타당성 자문 업무협약

- [2024 더벨 글로벌 투자 로드쇼-베트남]베트남의 지오영 '바이메드'·전기오토바이 '셀렉스' 눈길

- 지아이에스, 코스닥 상장 위한 예비심사신청서 제출

- [꿈틀대는 토큰증권 시장]'업계 표준' 루센트블록, '두자릿수' 레코드 조준

- [Company & IB]조달 '막바지' 롯데그룹, 롯데케미칼에 쏠리는 눈

- '910억 CB 발행' 아스트, 경영 정상화 속도 낸다