KIC’s alternative assets allocation reduced for two straight years The result was due to stellar returns from traditional markets

Translated by Ryu Ho-joung 공개 2021-10-20 08:10:44

이 기사는 2021년 10월 20일 08:08 thebell 에 표출된 기사입니다.

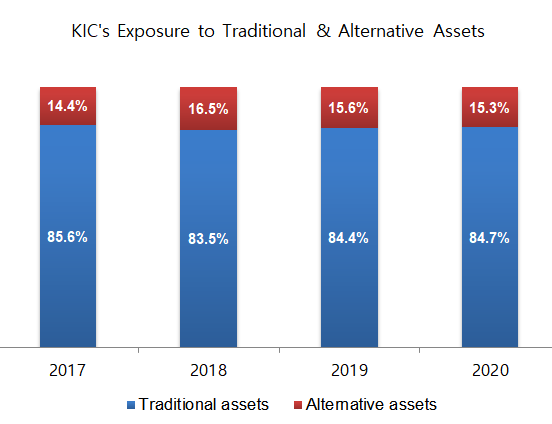

South Korea’s sovereign wealth fund Korea Investment Corporation (KIC) has seen its allocation to alternative assets decrease for two straight years, 2019 and 2020, in contrast to most of the other domestic institutional investors seeking to expand their exposure to asset classes such as private equity, infrastructure and hedge funds.KIC started to invest in alternative assets in 2009 and has continued to increase its allocation to the asset classes each year until 2018 when exposure peaked at 16.5% (based on net asset value). Since then, exposure decreased to 15.6% in 2019 and 15.3% in 2020.

This contrasts with moves by other South Korean institutions investors, including pension funds and mutual aid associations, which have ramped up investments in alternative asset classes in recent years in an effort to enhance returns and diversify beyond traditional assets such as stocks and bonds.

These seemingly opposite trends were pointed out by lawmakers during a 2020 inspection of state administration. They called on KIC to increase its allocation to alternatives and come up with ways to manage liquidity by following practices of its global peers which earn stable and high returns through diversification into alternative investment strategies.

In its recent report submitted to lawmakers, KIC explained that a decline in exposure to alternatives was caused by stellar returns on traditional assets and therefore will be temporary.

The sovereign wealth fund’s traditional asset portfolio gained 16.6% and 14.6% in 2019 and 2020, much higher than returns of 9.0% and 9.2% from investments in alternative assets for the respective year.

“Traditional assets gained a higher return than alternatives, resulting in a decrease in exposure to alternative investments as a percentage of the total assets,” KIC said in the report. “We have made continued efforts to expand our allocation to alternative assets and this has been also shown in an increase in our new alternative investments.”

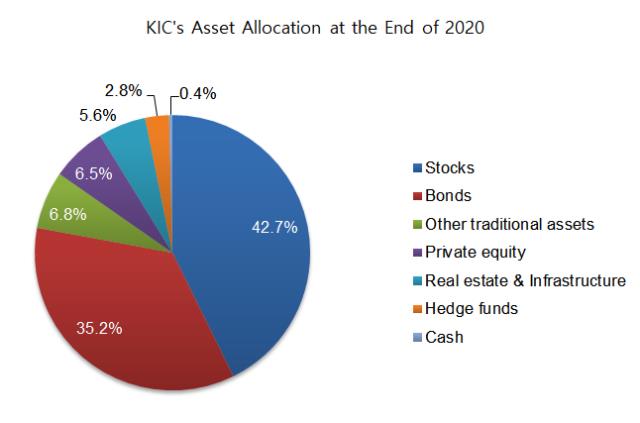

KIC’s new investments in alternative assets have continued to grow in dollar terms, from $21.6 billion in 2018 to $24.5 billion in 2019 to $27.9 billion in 2020. Especially, its allocation to private equity jumped from $9.3 billion in 2019 to $11.8 billion in 2020, compared to investments in infrastructure and real estate, which rose by about $500 million in the same period.

“An aggressive increase in the allocation to alternatives in a short period of time could lead to exposure concentrated in funds of a certain vintage,” KIC said. “We plan to increase new investments gradually each year to earn stable returns.”

KIC also said that, given the illiquid nature of alternative assets, it is managing alternative investments not to exceed a preset limit and that it updates its liquidity contingency plan on an annual basis to be prepared for crisis.

Lawmakers also demanded last year that KIC expand investments in companies with innovative technologies. KIC said in the report that it is exploring such investment opportunities in partnerships with other domestic institutions. As part of such efforts, KIC announced a joint venture with South Korea’s NongHyup in July last year to ramp up private equity investments overseas.

KIC had $183.1 billion in assets under management at the end of 2020, with exposure to alternative investments accounting for 15.3%. (Reporting by Hee-yeon Han)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

best clicks

최신뉴스 in 전체기사

-

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]인니 정부, 친기업 정책 드라이브에 뜨거운 관심 '체감'

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]"유망 스타트업 양성소, 글로벌 투자 거점 부상"

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]"철저히 투자금융 관점서 봐야, 전략적 접근시 유리"

- [2023 더벨 글로벌 투자 로드쇼-베트남]신용보증기금, 중기 베트남 진출 지원에 팔 걷었다

- [2023 더벨 글로벌 투자 로드쇼-베트남]인프라·산업 투자 증가, 부동산 가격 상승 견인

- [2023 더벨 글로벌 투자 로드쇼-베트남]떠오르는 신규 투자처 '온실가스 감축 프로젝트'

- [2023 더벨 글로벌 투자 로드쇼-베트남]VITASK, 베트남 현지 기업 생산·기술력 개선 앞장

- [2023 더벨 글로벌 투자 로드쇼-베트남]급성장 '핀테크' 산업, 전자 결제·P2P·초단기 분야 각광

- [2023 더벨 글로벌 투자 로드쇼-베트남]진출 계획시 세무 접근 필요, '우대세율·감면' 활용해야 '득'

- [2023 더벨 글로벌 투자 로드쇼-베트남]한국이 투자 주춤할 때 태국은 과감히 '베팅'