Hyundai Oilbank’s high dividend payouts in spotlight ahead of IPO Korean oil refiner’s high dividend payout ratio likely to attract investors in planned IPO

Translated by Ryu Ho-joung 공개 2022-01-19 08:14:28

이 기사는 2022년 01월 19일 08:12 thebell 에 표출된 기사입니다.

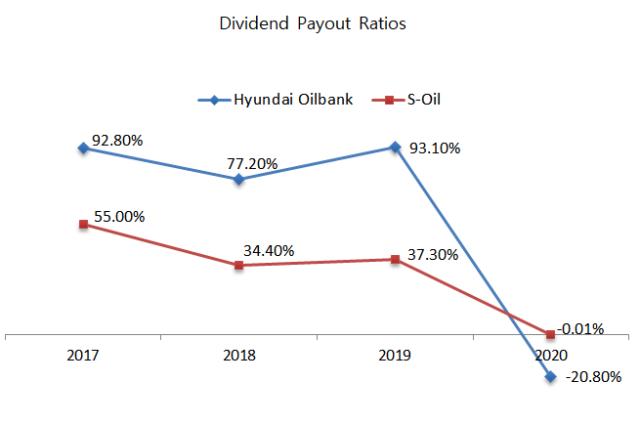

Hyundai Oilbank’s relatively high dividend payout ratio could appeal to investors looking for regular income in its planned initial public offering in the first half of this year.The South Korean oil refiner has paid more than 1.18 trillion won ($994 million) in dividends over the four years from 2017 to 2020, or 100.6% of net profits totaling 1.17 trillion won in the same period, as it continued to pay dividends despite a net loss in 2020 after a collapse in oil prices due to the Covid-19 pandemic.

The company’s yearly dividend payout ratio averaged around 80%, the highest among the country’s four major oil refiners, and especially much higher in comparison to roughly 50% for key peer S-Oil.

S-Oil is the only listed company among pure refiners in South Korea. SK Innovation’s shares are also publicly traded but its business includes making electric vehicle batteries as well as oil refinery. GS Caltex remains in private hands.

Assuming that Hyundai Oilbank’s target valuation for its IPO is calculated based on S-Oil’s price-to-book or price-to-equity ratios, Hyundai Oilbank, which pays more dividends than its rival, could be more attractive to investors.

It is also notable that Hyundai Oilbank has continued to boost investment for future growth at the same time, with the company spending 2 trillion won on capital expenditure in 2020, up from 883 billion won in 2019 and 759 billion won in 2018.

The company’s capital expenditure spending was mostly related to building a heavy-feed petrochemical complex (HPC), which is expected to be operational later this year and generate an operating profit of some 500 billion won annually. The new facility is also expected to help lower the volatility of profits as its margin will likely improve earnings during falling oil prices.

“Paying more dividends than any other company in the industry while continuing to increase capital expenditure means Hyundai Oilbank has a strong fundamental, which highlights its attractiveness compared to other industry players,” an analyst said.

Highest conversion rate

Industy experts say it is a high level of profitability that allows the company to pay large dividends and spend a lot of money on investments at the same time.

Oil refiners use conversion process units to shift the yield of the refinery away from less valuable products such as residual fuel and toward high-value ones such as gasoline and diesel. Hyundai Oilbank has the conversion rate of 40%, the highest among the country’s top four oil refiners.

When oil demand and prices plunged in 2020, Hyundai Oilbank recorded 626 billion won in operating loss, which represented an operating loss margin of 5%. This compared to an operating loss margin of 9.8% for SK Innovation, 6.7% for GS Caltex and 13.4% for S-Oil.

Hyundai Oilbank also achieved the highest profitability among peers in 2016 when domestic oil refiners enjoyed strong earnings growth, with an operating profit margin of 7.1%, compared to SK Innovation’s 6.8%, GS Caltex’s 6.9% and S-Oil’s 6.1%.

“Hyundai Oilbank is expected to maintain stable dividend payouts because its HPC project is likely to help lessen the volatility of future earnings,” an analyst said. (Reporting by Kyung-ju Lee)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]인니 정부, 친기업 정책 드라이브에 뜨거운 관심 '체감'

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]"유망 스타트업 양성소, 글로벌 투자 거점 부상"

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]"철저히 투자금융 관점서 봐야, 전략적 접근시 유리"

- [2023 더벨 글로벌 투자 로드쇼-베트남]신용보증기금, 중기 베트남 진출 지원에 팔 걷었다

- [2023 더벨 글로벌 투자 로드쇼-베트남]인프라·산업 투자 증가, 부동산 가격 상승 견인

- [2023 더벨 글로벌 투자 로드쇼-베트남]떠오르는 신규 투자처 '온실가스 감축 프로젝트'

- [2023 더벨 글로벌 투자 로드쇼-베트남]VITASK, 베트남 현지 기업 생산·기술력 개선 앞장

- [2023 더벨 글로벌 투자 로드쇼-베트남]급성장 '핀테크' 산업, 전자 결제·P2P·초단기 분야 각광

- [2023 더벨 글로벌 투자 로드쇼-베트남]진출 계획시 세무 접근 필요, '우대세율·감면' 활용해야 '득'

- [2023 더벨 글로벌 투자 로드쇼-베트남]한국이 투자 주춤할 때 태국은 과감히 '베팅'