GEPS wants to boost alternative investments abroad Korean pension scheme considers investing more in global private market

Translated by Ryu Ho-joung 공개 2021-10-08 07:41:48

이 기사는 2021년 10월 08일 07:34 thebell 에 표출된 기사입니다.

South Korea’s Government Employees Pension Service (GEPS) is considering issuing a request for proposals (RFP) to award additional funds for its alternative investments abroad.The pension fund is considering awarding a private equity or private debt mandate totaling up to $150 million to three managers, industry sources said on Wednesday, though details have not been finalized yet. It appears that the RFP could be issued as early as before the end of this year.

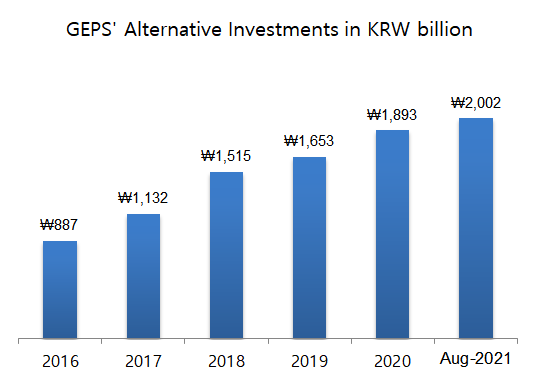

The move is part of the South Korean investor’s efforts to boost alternative investments abroad. GEPS under chief investment officer Seo Won-joo has been stepping up efforts to diversify its alternative asset portfolio, especially in the global market, for higher returns.

GEPS in 2019 awarded a total of $100 million to HarbourVest Partners and Lexington Partners, the US investment firms that specialize in buying secondhand stakes in private equity funds. This was the pension scheme’s third investment in secondary funds after it awarded mandates for the strategy in 2014 and 2016.

Earlier this year GEPS selected Goldman Sachs, Macquarie and Ardian to give infrastructure mandates totaling $115 million. The tender process to select infrastructure fund managers attracted strong interest, with more than 10 proposals received from global investment firms.

GEPS had more than 8.2 trillion won ($7 billion) in assets under management at the end of 2020, with exposure to alternative investments accounting for approximately 22%. It intends to gradually increase its allocation to alternative assets to 33% by 2025.

“GEPS plans to invest more in alternative assets through various ways such as co-investments and also continue to try to enhance internal capabilities,” an industry source said. (Reporting by Gyoung-tae Kim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- '3D 세포 관찰' 토모큐브의 상장 재도전, 예심 신청

- 'K-방산' MNC솔루션, 대표주관사 'KB증권'

- 율호,정부 핵심광물 공급망 확대 지원 선정

- 김연수 한컴 대표, '탁월한 선구안' AI 빅테크 이끈다

- CBI 관계사 지비이노베이션, 쌍전광산 장비설비 구축

- [간판펀드 열전]메가펀드 옛 영광 한투네비게이터 '리부트'

- 오가노이드사이언스, 기평 신청…사업성 입증 '관건'

- '개인안전장비 1위' 한컴라이프케어, 새 주인 찾는다

- [HD현대마린솔루션 IPO]고밸류 vs 저밸류…'피어그룹' 훌쩍 넘은 성장 여력

- [Company & IB]글로벌 신용평가 받은 롯데렌탈…'동향' 살피는 IB