Banks struggles to justify LG CNS’ IPO valuation There is gap between IT service company’s OTC market value and P/E multiple valuation

Translated by Ryu Ho-joung 공개 2022-05-09 07:58:19

이 기사는 2022년 05월 09일 07:56 thebell 에 표출된 기사입니다.

Investment bankers are struggling to justify a higher valuation for LG CNS than its listed peer Samsung SDS in its planned initial public offering despite its strong earnings growth, as the South Korean information technology services company lacks strengths that differentiate it from its competitors.Investment banks invited by LG CNS to pitch for roles in its IPO put a valuation of between 6 trillion won and 7 trillion won ($5.5 billion) on the company based on what its stock is traded at in the over-the-counter market.

This valuation is higher than Samsung SDS, LG CNS’ closest peer listed on Kospi. Based on Tuesday’s closing price and 633.4 billion won in net profit in 2021, Samsung SDS’ price-to-earnings (P/E) ratio is around 17.7 times. This P/E ratio represents a valuation of only 4 trillion won for LG CNS based on its 2021 net profit.

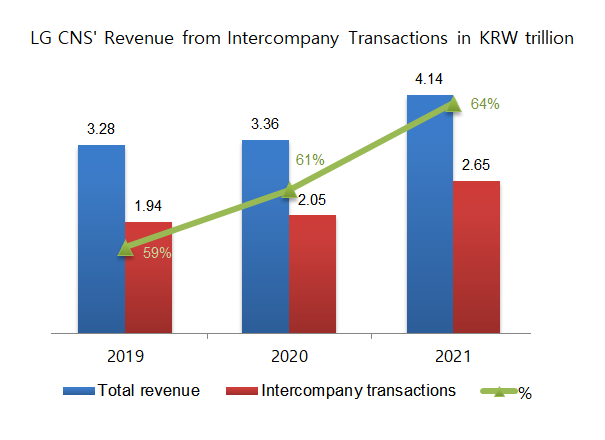

LG CNS might be able to justify a higher valuation if it has strengths that can differentiate the company from its rivals. One of those strengths was its lower reliance on intercompany transactions.

Intercompany transactions accounted for 59% of LG CNS’ total consolidated revenue in 2019. But the proportion rose to 64% in 2021, closer to 68% for Samsung SDS. The figure could have further increased if revenue from LX Group, which spun off from LG Group in May last year, was included.

LG CNS is also making little progress with its new businesses. In 2019, the company created a data and analytics team as part of efforts to ramp up its cloud computing business. Kim Eun-saeng, former vice president of Dell Technologies, was named to lead the team. But without notable results, Kim stepped down from the role earlier this year.

“It will be difficult for LG CNS to justify the 7 trillion won valuation,” an investment banking source said. “There are not many things that can be done until the IPO except hoping market conditions improve.” (Reporting by Yoon-shin Choi)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- 스튜디오산타클로스ENT, 주주권익 보호 '구슬땀'

- 이에이트, AI 시뮬레이션·디지털 트윈 기술 선보여

- MBK, '몸값 2조' 지오영 인수 SPA 체결 임박

- [2024 더벨 글로벌 투자 로드쇼-베트남]한인이 설립한 RCE, 세계 첫 ‘중장비 온라인 중고거래’

- 회계법인 해솔, 부동산 타당성 자문 업무협약

- [2024 더벨 글로벌 투자 로드쇼-베트남]베트남의 지오영 '바이메드'·전기오토바이 '셀렉스' 눈길

- 지아이에스, 코스닥 상장 위한 예비심사신청서 제출

- [꿈틀대는 토큰증권 시장]'업계 표준' 루센트블록, '두자릿수' 레코드 조준

- [Company & IB]조달 '막바지' 롯데그룹, 롯데케미칼에 쏠리는 눈

- '910억 CB 발행' 아스트, 경영 정상화 속도 낸다