Pearl Abyss forms ESG committee as its global exposure increases Korean gaming firm’s ESG rating was downgraded from BB to B by MSCI last year

Translated by Ryu Ho-joung 공개 2022-05-11 08:13:26

이 기사는 2022년 05월 11일 08:13 thebell 에 표출된 기사입니다.

South Korean gaming firm Pearl Abyss established a committee in charge of environmental, social and governance (ESG) issues as part of efforts to strengthen its ESG practices, with the company’s exposure to developed Western markets continuing to increase.The ESG committee was created under the company’s board of directors in March, according to industry sources. This came after Pearl Abyss formed an ESG task force last June, the first such move among gaming companies listed on Kosdaq.

These moves are in line with ESG efforts in the South Korean gaming industry. NCSoft formed an ESG committee in March last year and other large gaming companies like Com2uS and Netmarble followed suit. Several major firms in the industry also issued their first ESG reports.

Pearl Abyss is considered a relatively small player in the industry, with total assets of 1.35 trillion won ($1.06 billion) at the end of 2021. This compares to Netmarble’s 10.6 trillion won and NCSoft’s 4.5 trillion won.

The moves by Pearl Abyss to strengthen its ESG capabilities are ahead of its bigger rivals, such as Kakao Games and Krafton which do not have ESG committees. One of the biggest reasons for that is the company’s increasing exposure to developed Western markets, which are more conscious about ESG factors.

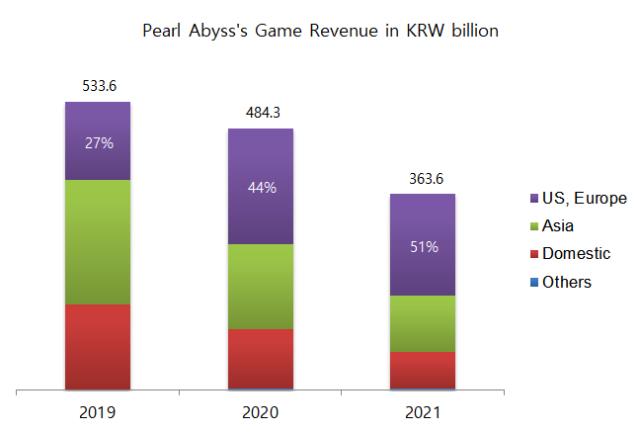

Pearl Abyss’ revenue from the US and Europe represented 51% of its total revenue in 2021, up from 27% in 2019 and 44% in 2020. This contrasts with other mid-sized South Korean gaming firms whose revenues mostly come from China and the Southeast Asian region.

Pearl Abyss is the only mid-sized South Korean gaming firm rated by MSCI ESG Research because its AAA games like Black Desert are popular among users in Western countries.

Pearl Abyss’ MSCI ESG rating was downgraded from BB to B in June last year, meaning the company is a laggard among 75 companies in the media and entertainment industry rated by MSCI.

The rating downgrade was largely because of a low score in the Governance pillar. Pearl Abyss was rated as a laggard on corporate governance and corporate behavior, the two key issues comprising the Governance pillar.

Pearl Abyss does not have an audit committee yet. Under South Korean law, companies with total assets of 2 trillion won or more are required to form an audit committee consisting of at least three members.

Pearl Abyss was also rated poorly in the Environment pillar like many other gaming companies. Massively multiplayer online game servers consume a large amount of power, leading to an increase in carbon emissions.

But the company was rated as a leader on privacy and data security, one of the key issues comprising the Social pillar. Pearl Abyss has an information security committee led by its chief information security officer and chief privacy officer. The committee’s members include the company’s top executives such as chief executive officer Heo Jin-young and chief technology officer Ji Hee-hwan.

The creation of the ESG committee may help improve Pearl Abyss’ ESG rating in the future, industry watchers said. The company’s plan to relocate its headquarters to Gwacheon, Gyeonggi Provice, in July is expected to help reduce its carbon emissions as well. (Reporting by Won-ji Hwang)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [아시아나 화물사업부 M&A]MBK 손잡은 에어프레미아, 다크호스 등극

- [대기업 프로스포츠 전술전략]전북현대, '돈방석' 기회 끝내 놓쳤다

- 골프존, 주가 하락에 발목잡혔나…GDR 분할 '무산'

- [Art Price Index]시장가치 못 찾은 퍼포먼스 작품

- 하이브 '집안싸움'이 가리키는 것

- 이익률 업계 톱인데 저평가 여전…소통 강화하는 OCI

- KB금융, 리딩금융의 품격 ‘주주환원’ 새 패러다임 제시

- 대외 첫 메시지 낸 최창원 의장의 속내는

- KG모빌리티, 라인 하나로 전기차까지

- [이사회 분석]갈 길 바쁜 LS이브이코리아, 사외이사 없이 간다