Late Nexon founder’s shares may trigger huge inheritance tax bill Inheritance of Kim Jung-ju’s 67.49% stake in NXC may result in $2.3 bil tax obligation

Translated by Ryu Ho-joung 공개 2022-03-04 08:22:54

이 기사는 2022년 03월 04일 08:02 thebell 에 표출된 기사입니다.

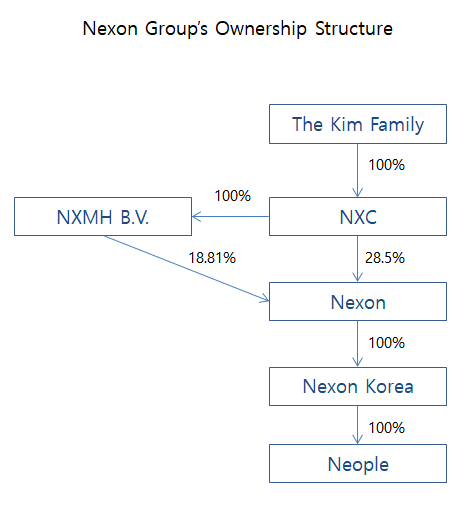

The death of Nexon founder, Kim Jung-ju, has raised the question of what will happen to his 67.49% stake in NXC Corp. If the asset is inherited by his family members, this could trigger a massive tax bill of over 2.8 trillion won ($2.3 billion).NXC, the Kim family’s private investment firm, is at the top of the Nexon group’s ownership structure. NXC directly owns 28.5% of Nexon, which is based in Japan, and owns an 18.8% stake in the video gaming company through its wholly owned subsidiary in Belgium, NXMH B.V. Nexon holds 100% of Nexon Korea, which controls several game studios including Neople.

NXC is 67.49% owned by Kim, 29.43% owned by his wife, Yoo Jung-hyun, and 0.68% each owned by his two children. The remaining 1.72% is held by Wise Kids, which is wholly owned by Kim’s two children.

If Kim left no will or direction about how to deal with his assets in the event of his death, his family members would inherit his shares in NXC as stipulated by the legal inheritance ratio.

That would produce a massive inheritance tax bill. Under South Korean law, the highest 50% tax is levied if the value of shares subject to inheritance exceeds 3 billion won. Moreover, an extra 20% rate is added in case of a controlling stake.

For tax purposes, the value of a privately-held company with no market price is determined as the greater of 80% of the per-share net asset value or the weighted average (3:2) of the per-share net profit or loss value and the per-share net asset value.

Based on an estimate of NXC’s net asset value of 3.06 million won per share, Kim’s 67.49% stake (1.963 million shares) is estimated to be worth about 4.8 trillion won. Given the highest tax rate of 50%, a 20% addition for a controlling ownership and a 3% cut for a voluntary tax report, the Kim family is expected to face an inheritance tax bill of at least 2.8 trillion won.

Under South Korean law, the Kim family should report inheritance tax within six months after the date Kim died, or until early September. The final tax amount is determined after an investigation by the tax authorities, which should be completed within nine months after the inheritance tax is filed. (Reporting by Choong-hee Won)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- 민희진 보유 어도어 지분, 하이브 콜옵션 행사할까

- [IB 풍향계]'전통강자' NH·한투 위축…IPO 새 판 짜여진다

- [IB 풍향계]미래에셋, IPO 순위경쟁 '가속화'

- [Korean Paper]'역대급' 발행에도…"투자자 피로도 없다"

- [Korean Paper]1년만에 돌아온 해진공, '정기 이슈어' 자리매김

- [IPO 모니터]속도 높이는 DN솔루션즈, '초대형' 주관사단 꾸렸다

- [IB 풍향계]'DN솔루션즈 파트너' 삼성증권 ECM1팀 빛났다

- [IPO 모니터]'밸류 낮춘' 전진건설로봇, '실적주' 흥행 이을까

- 공매도 금지 때문에...카카오, 해외EB 프리미엄 더 줬다

- 카카오-UBS 해외 EB 연결고리 '크레디트스위스'