Kurly valuation likely to triple to $2.7 bil in new funding round Grocery ecommerce startup plans to raise $2.7 million in funding before IPO

Translated by Ryu Ho-joung 공개 2021-04-20 07:52:38

이 기사는 2021년 04월 20일 07:46 thebell 에 표출된 기사입니다.

Kurly Inc, which operates grocery ecommerce platform Market Kurly, plans to raise additional capital in a new funding round that could value the company at as much as 3 trillion won ($2.69 billion).The Seoul-based company is working with Morgan Stanley to sound out investor interest, industry sources said. Kurly looks to raise about 300 billion won in a fresh funding round, which is likely to be led by private equity firms.

The planned funding round is expected to value Kurly at 3 trillion won on a pre-money basis, more than three-fold increase from the 900 billion won at which it was valued in its latest funding in May last year.

This could be the last funding round before Kurly files to go public. The grocery delivery startup is aiming to list by the end of this year, with Goldman Sachs, Morgan Stanley and JPMorgan acting as lead bookrunners. It is reportedly considering the US as a potential listing venue but has not yet made a final decision.

A flotation in the US, where ecommerce giant Coupang made its market debut last month, would allow Kurly to set its initial public offering (IPO) price higher than what is expected in a listing on local bourses, industry watchers said. Coupang’s market capitalization recently stood at $78 billion, about six times its sales of 14 trillion won in 2020. The same multiple would value Kurly at up to 6 trillion won, given its sales of nearly 1 trillion won last year.

Sophie Kim, founder and chief executive of Kurly, would also likely prefer a US listing because the company can adopt a dual-class share structure, which is not allowed in South Korea. Kim’s stake in Kurly has been diluted to 6.67% following several rounds of funding in the past years. The dual-class structure would enable Kim to retain control of the company despite her tiny stake.

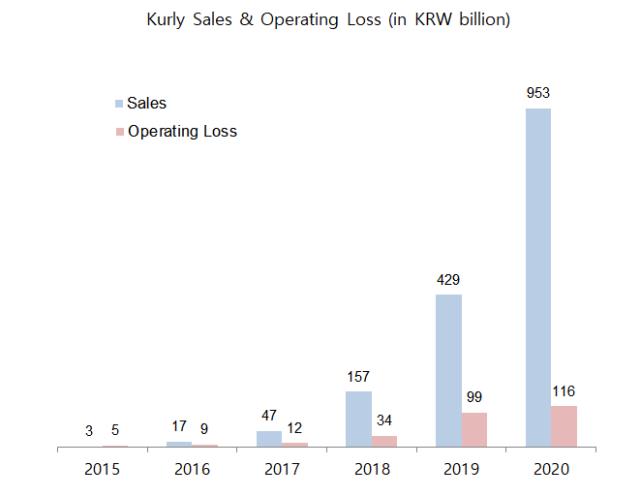

Kurly, which is known for its overnight grocery delivery service, has experienced rapid growth since its inception in 2014. Its sales have risen three hundred fold for the last five years, from a mere 2.9 billion won in 2015 to 952.3 billion won in 2020.

However, due to a significant increase in investments in logistics and marketing spend, Kurly’s operating loss has widened from 5.4 billion won to 116.2 billion won in the same period, bringing cumulative losses to 270 billion won.

Kurly says that its top-line growth will be able to continue to accelerate, aiming to expand its overnight delivery service to cities beyond Seoul and the metropolitan area this year. The company estimates the expansion would double its average daily orders from the current 220,000 boxes, helping it become profitable within the next two to three years.

But some are skeptical about the startup’s growth and profitability prospects, citing intensifying competition in the grocery ecommerce market. Kurly in particular faces competition from traditional retail giants armed with plenty of cash and a strong retail network. It remains unclear whether Kurly will be able to defend its market position from rising competition, critics said. (Reporting by Si-eun Park and Byung-yoon Kim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [북미 질주하는 현대차]윤승규 기아 부사장 "IRA 폐지, 아직 장담 어렵다"

- [북미 질주하는 현대차]셀카와 주먹인사로 화답, 현대차 첫 외국인 CEO 무뇨스

- [북미 질주하는 현대차]무뇨스 현대차 사장 "미국 투자, 정책 변화 상관없이 지속"

- 수은 공급망 펀드 출자사업 'IMM·한투·코스톤·파라투스' 선정

- 마크 로완 아폴로 회장 "제조업 르네상스 도래, 사모 크레딧 성장 지속"

- [IR Briefing]벡트, 2030년 5000억 매출 목표

- [i-point]'기술 드라이브' 신성이엔지, 올해 특허 취득 11건

- "최고가 거래 싹쓸이, 트로피에셋 자문 역량 '압도적'"

- KCGI대체운용, 투자운용4본부 신설…사세 확장

- 이지스운용, 상장리츠 투자 '그린ON1호' 조성