Kakao Pay’s IPO could value it at as high as $16 bln Analysts are optimistic about its business model focused on platform ecosystem

Translated by Ryu Ho-joung 공개 2021-05-12 08:04:24

이 기사는 2021년 05월 12일 07시50분 thebell에 표출된 기사입니다

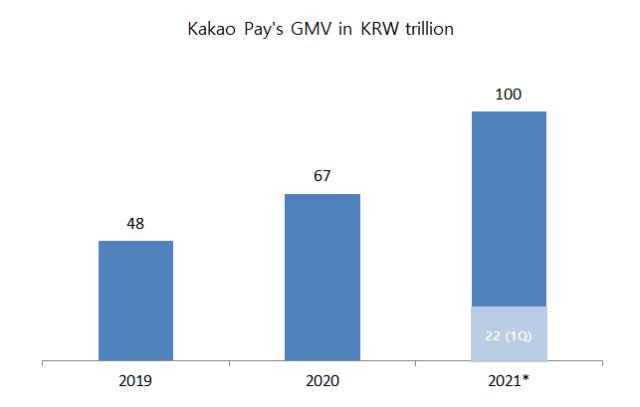

The planned initial public offering of Kakao Pay may value Kakao’s payment business at as much as 18 trillion won ($16 billion), according to estimates by analysts, underlining the promising growth prospects of the company.Analysts have put the company’s valuation at between 10 trillion won and 18 trillion won. The highest 18 trillion won valuation, estimated by eBest Investment & Securities, represents 0.18 times the company’s expected gross merchandise value (GMV) for 2021.

Kakao Pay’s GMV grew 40% year on year to 67 trillion won in 2020. GMV for the first quarter of this year came in 22.8 billion won, with the full-year figure expected to reach 100 trillion won.

Typically, the price to book ratio is used to value financial services firms. But GMV has been used for the valuation of Kakao Pay because of its business model focused on a platform ecosystem. A platform company, like Kakao Pay, needs heavy investment in resources in early years. But once its business ecosystem is formed, growth in revenue and earnings can accelerate dramatically.

Kakao Pay has partnerships with many other financial services firms – such as banks, credit card companies, insurers and brokerage firms – which sell their offerings on Kakao Pay’s platform. Continued growth in the platform’s users and GMV would allure more financial services firms to partner with the company, which in turn could lead to revenue growth.

Kakao Pay was spun off from Kakao in 2017. Its revenue grew 27-fold in the past three years, from 10.6 billion won in 2017 to 284.4 billion won 2020. Operating loss was reduced from 96.5 billion won in 2018 to 17.9 billion won in 2020, with the company expected to turn profitable this year.

Meanwhile, SK Securities and Shinhan Investment estimated Kakao Pay’s valuation to be 10.66 trillion won and 10.3 trillion won, respectively, based the company’s expected GMV this year.

KTB Investment & Securities estimated Kakao Pay to be worth 13.2 trillion won based on monthly active users (MAU). The valuation is equal to revenue per MAU of 737,000 won multiplied by the company’s MAU, which is expected to grow to 17.9 million this year. (Reporting by Hana Suh)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

best clicks

최신뉴스 in 전체기사

-

- 한화에어로, 동유럽 생산 '현지화'...내년에 자금 80% 투입

- [변곡점 맞은 해운업]매각 포석?...SK해운, 몸집 줄이기 돌입

- [중간지주 배당수익 분석]'새출발' 인베니, 투자·배당이익 선순환 집중

- [에쓰오일 밸류업 점검]미래투자·수익성 저하에 줄어든 '배당인심'

- [변곡점 맞은 해운업]'HMM과 협상' SK해운, 수익성 개선 '뚜렷'

- SK엔무브의 결혼식

- 토스뱅크 청사진 '글로벌·기업'…이은미 대표 진가 발휘하나

- [보험사 CSM 점검]DB손보, 가정 변경에 1.3조 증발…잔액 증가 '거북이 걸음'

- [지방 저축은행은 지금]스마트저축, 비수도권 순익 1위 배경엔 '리스크 관리'

- [금융사 KPI 점검/우리은행]'최대 배점' 재무지표, 건전성·수익성 전략 변화