What robotics means for Hyundai Motor Group and its chairman Robotics business could be final piece of puzzle for conglomerate’s ownership restructuring

Translated by Ryu Ho-joung 공개 2022-01-17 07:43:21

이 기사는 2022년 01월 17일 07:41 thebell 에 표출된 기사입니다.

At this year’s CES in Las Vegas, South Korea’s Hyundai Motor Group has revealed its ambitions to become a leading player in the robotics market.Appearing on the stage accompanied by Boston Dynamics’ four-legged robot named Spot, Hyundai Motor Group chairman Chung Eui-sun said that the conglomerate would expand future mobility solutions to “metamobility” by robotics.

There is speculation about why Chung put emphasis on robotics now at the world’s biggest tech show. There is no doubt that robotics technology – which is expected to generate synergies with other new businesses such as urban aerial mobility and smart factories – is one of the conglomerate’s future growth drivers. But some say it’s too early because there are no concrete results yet.

Industry experts connect the dots between Chung’s emphasis on robotics and the family-controlled conglomerate’s potential ownership restructuring.

While Chung took the reins of Hyundai Motor Group as chairman in October 2020, he needs to further strengthen his control over the conglomerate.

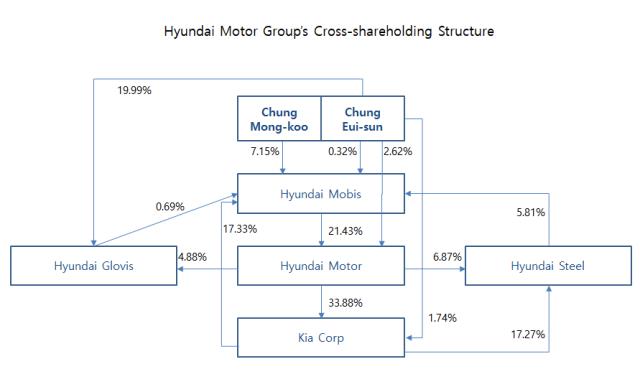

Chung owns a 2.62% stake in Hyundai Motor, the group’s the crown jewel, and a mere 0.32% stake in Hyundai Mobis, a key affiliate in the conglomerate’s ownership structure.

While he has maintained control over the conglomerate through a complex web of cross-shareholdings, this structure needs to be reformed because it’s not sustainable in the long term and in terms of regulatory compliance.

The ownership restructuring would require a huge amount of money. If Chung opts to purchase a combined 23.83% stake in Hyundai Mobis held by Kia Corp, Hyundai Steel and Hyundai Glovis, this would cost him nearly 6 trillion won ($5 billion) based on the closing price of 262,000 won apiece on January 10.

Potential IPO

Boston Dynamics could be the last piece of the puzzle in completing the conglomerate’s ownership restructuring.

Hyundai Motor Group bought 80% of the US robotics company for 956 billion won from Japan’s SoftBank Group two years ago. Hyundai Motor, Hyundai Mobis and Hyundai Glovis hold 30%, 20% and 10% stakes, respectively, while Chung owns a 20% stake in the robot maker.

The acquisition was to secure a leading presence in the field of robotics, Hyundai Motor Group said at the time, forecasting the robotics market to grow at an average annual rate of 32% to $177.2 billion by 2025.

The conglomerate also said that Chung’s stake purchase in the robot maker was intended to reinforce responsible management and make it clear that it was committed to continuing to invest in the technology.

Chung’s investment in Boston Dynamics, a rare move for him, drew attention from industry watchers, raising speculation about his bigger picture.

Boston Dynamics is expected to start preparations for an initial public offering in the coming years. If the company successfully goes public at a high valuation, Chung would be able to pocket big bucks, which could be used to buy shares in Hyundai Mobis. (Reporting by Su-jin Yoo)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

- Hyundai Motor Group chairman cuts stake in shipping arm

- Hyundai Motor’s expansion to Asia Pacific may get boost from G20 Bali summit

- Hyundai Motor Group reduces role of China unit head

- Hyundai Motor gears up for expansion into Japan 12 years after exit

- Hyundai Motor accelerates push for EV production in US

- Hyundai Motor-backed 42dot raises $88 mil in Series A funding

best clicks

최신뉴스 in 전체기사

-

- [퍼포먼스&스톡]꺾여버린 기세에…포스코홀딩스, '자사주 소각' 카드 재소환

- [퍼포먼스&스톡]LG엔솔 예견된 실적·주가 하락, 비용 절감 '집중'

- [퍼포먼스&스톡]포스코인터, 컨센서스 웃돌았지만 주가는 '주춤'

- 신한금융, ‘리딩금융’ 재탈환에 주주환원 강화 자신감

- 젬백스링크, 포니 자율주행자동차 국내 도입

- 더테크놀로지, 전략 수집 RPG '리버스 삼국' 출시

- [ICTK road to IPO]빅테크 고객사들이 상장 청원한 사연은

- '무차입' 씨피시스템, 상장으로 퀀텀점프 노린다

- 금양인터, 미국 프리미엄 와인 '벨라 오크스' 출시

- [ICTK raod to IPO]2년 뒤 매출 300억, 근거는 '글로벌 빅테크'