Hyundai Motor Group chairman cuts stake in shipping arm Stake sale comes after enforcement of tightened rules on family-controlled conglomerates

Translated by Ryu Ho-joung 공개 2022-01-07 09:58:59

이 기사는 2022년 01월 07일 09:51 thebell 에 표출된 기사입니다.

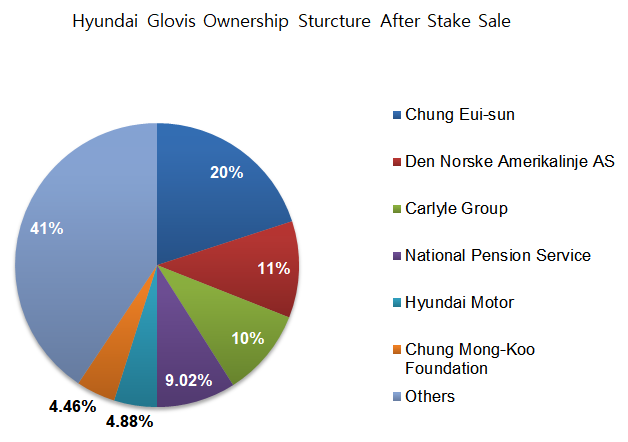

US private equity firm Carlyle Group has purchased a 10% stake in Hyundai Glovis from Hyundai Motor Group chairman Chung Eui-sun and his father and honorary chairman, Chung Mong-koo, for 611.3 billion won ($510 million) in a deal that allowed the head of the South Korean conglomerate to sidestep the country’s tightened regulations on family-controlled conglomerates.Chung Eui-sun and his father sold 3.29% and 6.71% of the shipping company, respectively, to the private equity firm at a price of 163,000 won via a block trade to reduce their stakes to 20% and zero, according to a regulatory filing on Wednesday.

The transaction has made Carlyle Group the third largest shareholder of Hyundai Glovis, after chairman Chung and Den Norske Amerikalinje AS, a subsidiary of Norwegian maritime group Wilh. Wilhelmsen Holding ASA.

Carlyle Group and Chung also struck a deal to jointly hold shares in the company, giving the private equity firm the rights to nominate one board director and to take part in a sale of shares by the chairman to a third party.

The stake sale by the Chung family comes after the enforcement of the revised competition rules, which went into effect on December 30, 2021. Previously, companies in which the owner’s family members together hold a 30% or more stake were regulated by the Korea Fair Trade Commission. But the threshold has been lowered to 20% under the amended law.

Among such companies, the country’s competition watchdog targets those that generate 20 billion or more in revenue from transactions with their affiliates, or whose intercompany transactions represent 12% or more of total revenues.

Hyundai Glovis reported revenue of 12.9 trillion won in 2020, of which 3 trillion won, or around 23% of the total, came from domestic intercompany transactions. The proportion increased to nearly 70% when transactions with its overseas affiliates were included.

The company was founded to provide logistics and shipping services for Hyundai Motor’s and Kia Corp’s vehicles, and therefore is naturally highly dependent on transactions with the two automakers.

This is the second time that chairman Chung and his father cut their stakes in Hyundai Glovis due to the country’s competition regulations. In 2015, they sold 13.39% of the company via a block deal to reduce their combined stake from 43.39% to 30%.

Chung has pocketed approximately 200 billion won from the recent stake sale and is also expected to secure about 400 billion won by selling part of his shares in Hyundai Engineering in the company’s planned initial public offering slated for later this year. It is likely that he will use the money to strengthen his control over the conglomerate. (Reporting by Su-jin Yoo)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- '재무개선' AJ네트웍스, 조달비용 '확' 낮췄다

- '9년만에 엑시트' 한앤코, 한온시스템 거래구조 살펴보니

- 한국타이어앤테크놀로지, 한온시스템 인수한다

- [수술대 오른 커넥트웨이브]2대주주 지분매입 나선 MBK, 주식교환 카드 꺼냈다

- [이사회 모니터]이재용 에이비프로바이오 대표, 바이오·반도체 신사업 '드라이브'

- 와이투솔루션, 주인 바뀌어도 '신약' 중심엔 美 합작사 '룩사'

- 아이티센, 부산디지털자산거래소 본격 출범

- 아이에스시, AI·데이터센터 수주 증가에 '날개'

- [이사회 모니터]서정학 IBK증권 대표, ESG위원회도 참여 '영향력 확대'

- SW클라우드 '10주년' 폴라리스오피스, “초격차 밸류업”