Kakao chair opts not to extend loans backed by his shares Kim Beom-su last year fully repaid debt he took out using Kakao shares as collateral

Translated by Ryu Ho-joung 공개 2022-01-26 08:04:46

이 기사는 2022년 01월 26일 08시03분 thebell에 표출된 기사입니다

Kim Beom-su, founder and chairman of South Korean tech giant Kakao Corp, last year dropped a pledge of shares as collateral against a personal loan, a move seen as part of efforts to keep a low profile following the controversy over Kakao’s affiliates and his personal company K Cube Holdings.In November last year, Kim repaid a 50 billion won ($41.8 million) loan he took out using his 1.49 million shares in Kakao as collateral at an interest rate of 2.29%, fully unwinding a pledge of the company’s shares against his personal loan, according to industry sources.

The Kakao chairman, who is the company’s largest shareholder, first pledged part of his shares to borrow 30 billion won from Samsung Securities in November 2016. The following year, he extended the loan and took out an additional 60 billion by pledging more of his shares.

Since then, Kim had continued to extend the maturity of those loans. However in May 2021, he opted to repay 40 billion won when it matured and also repaid the remaining 50 billion won six months later.

The move is seen as part of his efforts to avoid further controversy after Kakao’s affiliates were at the center of criticism a few months ago. Kakao Mobility’s service fee hike in August last year sparked concerns about its unrivaled dominance in the market, ending up with Kakao’s other key affiliates facing criticism over their aggressive expansion across industries at the expense of small business owners.

When Kim appeared before lawmakers during an annual inspection of the state administration in October, he apologized and promised to overhaul the governance of the group.

Some lawmakers at the time took issue with K Cube Holdings as well, saying that it had been Kakao’s de facto holding company and this could be a violation of the principle of “separation of industrial and financial capital”.

K Cube Holdings, which is wholly owned by Kim, is the second largest shareholder of Kakao with a roughly 10% stake. Notable is that the amount of a loan taken out by K Cube Holdings against its shares in Kakao also significantly reduced from 195 billion won to 50 billion won last fall.

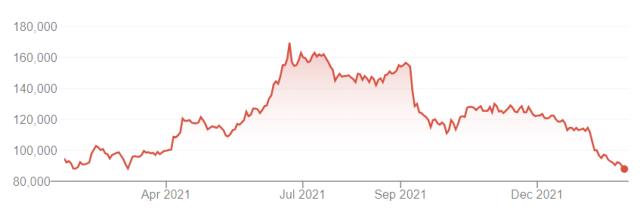

Kim’s unwinding a pledge of shares coincides with a plunge in the price of Kakao shares in recent months, which would have caused him to pledge more shares if he opted to extend the loans.

The value of Kim’s shares in Kakao has recently fallen to nearly 5.4 trillion won since hitting 9.6 trillion won in June last year as the share price of Kakao declined more than 30% in the past two months.

Kim previously pledged to donate more than half of his wealth to help solve social issues by joining the Giving Pledge campaign early last year. (Reporting by Seul-gi Kim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- 청약증거금 2조 몰린 쎄크, 공모청약 흥행 '28일 상장'

- [영상/Red&Blue]겹경사 대한항공, 아쉬운 주가

- [i-point]모아라이프플러스, 충북대학교와 공동연구 협약 체결

- [i-point]폴라리스오피스, KT클라우드 ‘AI Foundry' 파트너로 참여

- [i-point]고영, 용인시와 지연역계 진로교육 업무협약

- [i-point]DS단석, 1분기 매출·영업이익 동반 성장

- [피스피스스튜디오 IPO]안정적 지배구조, 공모 부담요소 줄였다

- 한국은행, 관세 전쟁에 손발 묶였다…5월에 쏠리는 눈

- [보험사 CSM 점검]현대해상, 가정 변경 충격 속 뚜렷한 신계약 '질적 성과'

- [8대 카드사 지각변동]신한카드, 굳건한 비카드 강자…롯데·BC 성장세 주목