Samsung’s shift to holding company structure unlikely for now Such overhaul is unlikely in the near future due to regulatory and tax constraints

Translated by Ryu Ho-joung 공개 2021-04-30 07:59:28

이 기사는 2021년 04월 30일 07시56분 thebell에 표출된 기사입니다

The estate plans of Samsung’s Lee family have once again prompted debate on whether South Korea’s largest conglomerate will shift to a holding company system, although such an overhaul seems unlikely in the near future.The Lee family, including late chairman Lee Kun-hee’s wife and three children, unveiled Wednesday plans to pay 12 trillion won ($10.8 billion) inheritance taxes, the country’s largest ever, in six installments over five years, alongside plans to donate a large collection of artwork and 1 trillion won to build new medical facilities.

However, they have not disclosed plans on how to distribute the late chairman’s company shares between family members, which have been closely watched due to their potential impact on Samsung’s corporate governance.

Analysts believe that the Lees have already agreed to give the bulk of Lee Kun-hee’s stakes in Samsung’s key affiliates to his son, Samsung Electronics vice president Lee Jae-yong, so that he could strengthen his control of the company.

Another topic that has drawn attention is whether Samsung will transfer one of its key affiliates – Samsung C&T Corp, Samsung Electronics and Samsung Life Insurance – to a holding company. After Lee Kun-hee’s October death, speculation arose that the conglomerate could use the inheritance process to prepare for a possible shift to a holding company system.

However, such an overhaul seems unlikely for now given regulatory and tax constraints, industry watchers said.

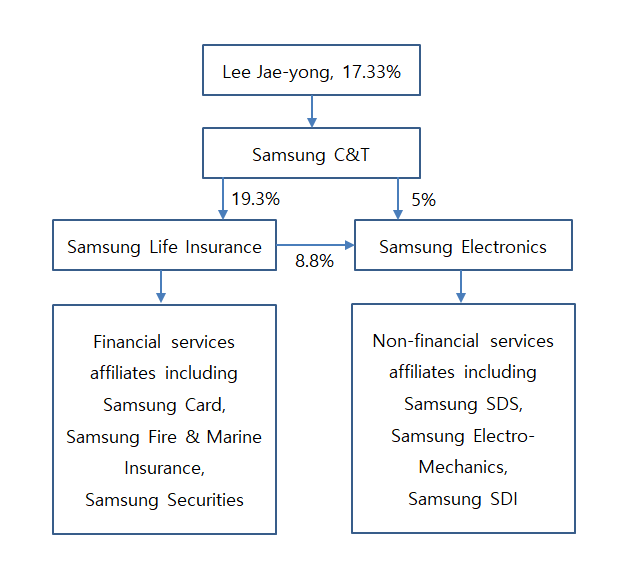

Samsung already completed its corporate governance restructuring, which was aimed at abandoning a complex web of cross-shareholdings. Under the current ownership structure, Lee Jae-yong controls Samsung Electronics through Samsung C&T, which is the conglomerate’s de facto holding company, and Samsung Life Insurance.

The country’s fair trade law was amended at the end of last year to raise a holding company’s shareholding threshold in a listed subsidiary from 20% to 30%. To shift Samsung C&T to a holding company, the conglomerate would need to pour hundreds of billions of dollars into raising Samsung C&T’s stake in Samsung Electronics from the current 5% to 30%, which seems very unlikely.

It is possible to transfer Samsung Electronics to a holding company. But Samsung has little reason to risk such a big change in corporate governance, especially in the absence of its head Lee Jae-yong. He has been in prison since January after receiving a 30-month sentence following his conviction for bribing the country’s ex-president. Another case related to the controversial 2015 merger between Samsung C&T and Cheil Industries will also likely take years to play out in court.

Tax benefits for a controlling shareholder of a conglomerate shifting to a holding company structure will also expire this year. “Samsung Electronics’ shift to a holding company is unlikely to happen, definitely not in the near future. Samsung will likely maintain the current structure of corporate governance for now,” said an analyst at one brokerage firm in Seoul.

However, the ruling party’s insurance business bill could complicate the situation. If this bill is passed by the National Assembly, Samsung Life Insurance would need to offload a large portion of its stake in Samsung Electronics. In this case, Samsung's shift to a holding company structure could gain momentum.

Some observers say, in the long term, a transition to a holding company structure could be a necessary step for Samsung to adopt a new system in which professional managers, not members of the owner’s family, run the businesses. Lee Jae-yong pledged in May last year that he would not hand over management control to his children. (Reporting by Hye-ran Kim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- 청약증거금 2조 몰린 쎄크, 공모청약 흥행 '28일 상장'

- [영상/Red&Blue]겹경사 대한항공, 아쉬운 주가

- [i-point]모아라이프플러스, 충북대학교와 공동연구 협약 체결

- [i-point]폴라리스오피스, KT클라우드 ‘AI Foundry' 파트너로 참여

- [i-point]고영, 용인시와 지연역계 진로교육 업무협약

- [i-point]DS단석, 1분기 매출·영업이익 동반 성장

- [피스피스스튜디오 IPO]안정적 지배구조, 공모 부담요소 줄였다

- 한국은행, 관세 전쟁에 손발 묶였다…5월에 쏠리는 눈

- [보험사 CSM 점검]현대해상, 가정 변경 충격 속 뚜렷한 신계약 '질적 성과'

- [8대 카드사 지각변동]신한카드, 굳건한 비카드 강자…롯데·BC 성장세 주목