HMM operating profit soars but unrealized derivatives loss erodes net profit Revaluation of convertible bonds issued to KDB results in unrealized loss of $763 million

Translated by Ryu Ho-joung 공개 2021-05-18 07:58:39

이 기사는 2021년 05월 18일 07시48분 thebell에 표출된 기사입니다

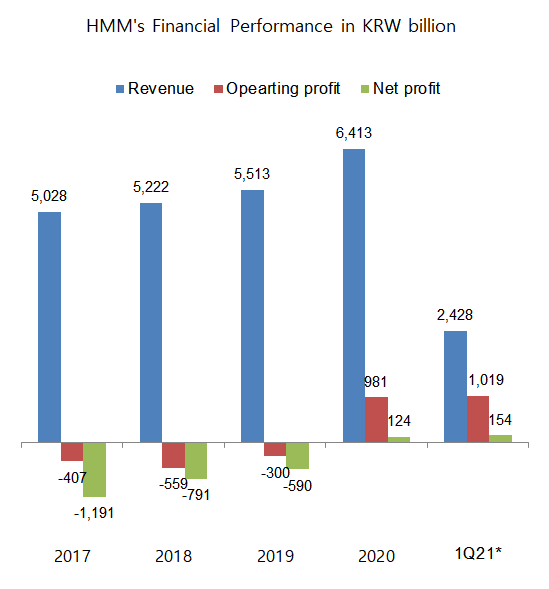

HMM has generated more than 1 trillion won in operating profit for the three months through March, surpassing the full-year annual record of 981 billion won ($864 million) set in 2020. But an unrealized loss related to convertible bonds has continued to weigh on the company's net profit.The company formerly known as Hyundai Merchant Marine said in a filing on Friday that its first-quarter revenue grew 85% year on year to 2.43 trillion won. HMM swung to an operating profit of 1.19 trillion won, a sharp turnaround from a 2 billion won operating loss in the same period last year. Operating profit margin soared to 42%.

The record results were largely attributable to increased freight and improved business conditions. The company also posted a net profit of 154 billion won, a turnaround from a loss of 66 billion won a year earlier. However, quarterly net profit was substantially eroded again by an unrealized derivatives loss.

In a separate filing, HMM revealed that it recognized an unrealized loss of 865 billion won – equivalent to 51% of the company’s total equity at the end of 2020 – in the first quarter after revaluing convertible bonds issued to its main lender Korea Development Bank (KDB).

HMM raised 300 billion won in December 2016 from KDB by issuing convertible bonds with a refix option, which allows the conversion price to be adjusted when the stock price falls.

The conversion price of the bonds was initially set at 6,269 won but eventually reduced to the face value of 5,000 won as the stock price of HMM fell from about 6,800 won at around the time of the bond’s issuance to as low as 2,120 won per share in March last year. At the conversion price of 5,000 won, KDB is entitled to convert the bonds into 60 million shares of common stock.

However, HMM shares started to rebound rapidly last summer in anticipation of improved financial results. This resulted in a substantial unrealized loss related to the convertible bonds, which was recognized in the income statement and eroded a net profit. HMM recognized a cumulative loss of 521 billion won on paper in the second half of last year.

The company will no longer suffer such losses when the convertible bonds mature on June 30. “Since the convertible bonds mature next month, the impact of an unrealized loss related to the securities will disappear in the third quarter and onward,” said an official at HMM.

KDB is expected to earn a significant gain by exercising the conversion option at 5,000 won, compared to HMM’s closing price of 43,700 won on Friday.

If the state-controlled bank, which is also the largest shareholder of the shipping company, converts all bonds to shares, its stake in HMM will increase from the current 11.93% to 24.96%. However, the country’s regulations forbid a bank to own 15% or more of a company other than its subsidiaries. That’s why many expect KDB to sell part of its stake in HMM soon.

“We are considering whether to exercise the conversion option,” said an official at KDB, but adding, "Nothing has been determined yet." (Reporting by Su-jin Yoo)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

best clicks

최신뉴스 in 전체기사

-

- [Korean Paper]코레일, 관세 전쟁 속 한국물 복귀전 나선다

- [유증&디테일]'초음파 DDS 선두' 아이엠지티, 임상시험 150억 조달

- 엠케이전자, '반도체 후공정 1위' ASE 어워드 수상

- [AACR 2025 프리뷰]신약 개발 속도내는 제이인츠바이오, 연구 2건 출격

- [AACR 2025 프리뷰]국내 항암 신약 투톱 유한양행·한미약품, '최다' 기록 쓴다

- 뉴로바이오젠, 6.5조 L/O에 1% 마일스톤…상업화 '관건'

- [제약사 개발비 자산화 점검]한미약품, '비만약' 28억 신규 산입…내년 출시 기대감 반영

- [AACR 2025 프리뷰]항암 신약 글로벌 진출 필수 관문, 커지는 K-바이오 존재감

- 2000억 현금 보유 일성아이에스, 부동산 베팅 '요양원' 발판

- OCI홀딩스, 부광약품 '유증' 활용법 '실권주·신주증서'