Share buybacks help Hyundai Motor shares jump amid pandemic Korean automaker has actively used share repurchases to enhance shareholder returns

Translated by Ryu Ho-joung 공개 2022-03-03 08:13:35

이 기사는 2022년 03월 03일 08:03 thebell 에 표출된 기사입니다.

Against the fallout of the Covid-19 pandemic and global supply chain disruptions, South Korean automotive giant Hyundai Motor has actively used share repurchases to boost shareholder returns, and it appears to have worked.Hyundai Motor started ramping up share buybacks in 2013: Its treasury shares increased by 20% from 1.1 million to 1.32 million, reducing the number of shares outstanding from some 209 million to 207 million in the same period. Hyundai Motor’s outstanding shares further decreased to about 204 million in 2018.

In April 2018, Hyundai Motor stepped up efforts to increase shareholder returns by retiring 6.61 million common shares and 1.93 million preferred shares, collectively worth 960 billion won ($796.5 million).

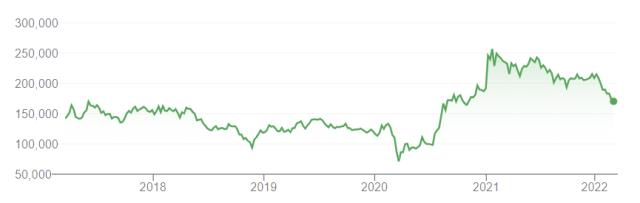

The move, which came 14 years after the company’s share retirement in 2004, immediately boosted the stock price, with Hyundai Motor shares jumping 11.5% to 160,000 won per share at the end of April 2018 from 143,500 won a month earlier.

Industry watchers at the time speculated that the automaker canceled shares to appease Elliott Management in response to the US hedge fund’s attack on the broader Hyundai Motor Group’s complex corporate governance structure, although Hyundai Motor dismissed such speculation.

Additionally, Hyundai Motor Group chairman Chung Eui-sun himself purchased a total of 581,333 Hyundai Motor shares in five trades in 2020, worth about 40.6 billion won, signaling his strong intention to prop up the company’s shares after the outbreak of the pandemic. He also bought 303,759 shares in Hyundai Mobis, the conglomerate’s auto parts arm, bringing the total he spent on buying shares in Hyundai affiliates to 81.7 billion won.

In March 2020, Hyundai Motor’s stock price plunged to a low of 65,000 won apiece due to concerns about the pandemic and the effect of global chip shortages on the automaker’s production.

However, the stock price of Hyundai Motor has since continued to recover to reach a high of 289,000 won in early January 2021, partly thanks to Chung’s share purchases and eased pandemic curbs. The increase in shares in Hyundai Motor and Hyundai Mobis gave Chung unrealized gains of about 130 billion won.

In November last year, Hyundai Motor announced another share buyback, purchasing shares worth 504.6 billion won in the past three months.

“The decision to buy back shares was made to increase shareholder returns and treasury shares held by the company will be used to strengthen our shareholder return policy in the mid to long-term,” Hyundai Motor said at the time. (Reporting by Seo-young Kim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- 김범수의 '법정' 자리이동

- [IR Briefing]삼성디스플레이, 갤럭시·아이폰 효과 '기대 이하'

- [IR Briefing]삼성전자, 트리폴드·보급형 폴더블폰 출시 시사

- [IR Briefing]'HBM 총력' 삼성전자, 엔비디아 HBM3E 공급 시사

- 삼성전자, 한경협 회비 납부 결정 '마무리까지 신중모드'

- [BBW 2024]바이낸스 CMO "성장한 시장에 맞는 마케팅 필요해"

- [BBW 2024]바이낸스 CCO "규제준수 최우선, 최고 전문가로 팀 구성"

- [BBW 2024]바이낸스 설립자 CZ, 두바이서 수감생활 이야기 눈길

- 쌍용건설, 영종도 복합리조트 공사비 회수 '언제쯤'

- 세빌스코리아, 이수정 대표 3년 연임 성공