Macquarie raises stake in SK Square to over 5% Australia-headquartered firm bargain hunts in SK Group’s intermediate holding company

Translated by Ryu Ho-joung 공개 2022-03-15 07:57:10

이 기사는 2022년 03월 15일 07시41분 thebell에 표출된 기사입니다

Macquarie Group has increased its stake in SK Square, the intermediate holding company of South Korea’s SK Group, to over 5% by capitalizing on the lower stock price in expectations for the potential upside of the company whose subsidiaries are eyeing public listings later this year.Macquarie Investment Management Business Trust, wholly owned by Australia-headquartered Macquarie Group Limited, currently holds 5.08% of SK Square, according to a filing on Friday.

The filing comes after the asset manager purchased 7,059,769 shares and 127,999 shares in SK Square respectively on March 2 and March 3 in the open market, raising its stake above the 5% threshold that requires shareholders to report their shareholdings in the company under South Korean law.

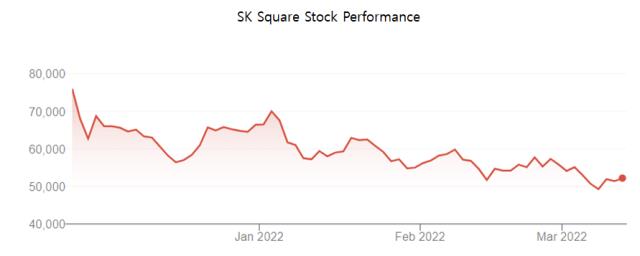

The stock price of SK Square, which spun off from SK Telecom in November last year, ended at around 55,000 won ($44.38) on those days, nearly 30% down from its first trading day's closing price of 76,000 won.

The relationship between Macquarie and SK Group began in 2011 when Macquarie Securities provided financial advice to SK Telecom alongside Merrill Lynch on the telco’s acquisition of Hynix Semiconductor.

In 2018, SK Telecom recruited Ha Hyung-il from the investment firm. Ha, vice president and head of SK Telecom’s corporate development center, served as chief executive of Macquarie Finance Korea before joining the mobile carrier.

The two firms also teamed up to acquire ADT Caps from Carlyle Group in 2018. Macquarie invested in the security service provider through a special purpose company, Blue Security Investment.

After its merger with SK infosec last year, ADT Caps was renamed SK shieldus and SK Square became its largest shareholder. Blue Security Investment remains the second largest shareholder of SK shieldus with a 37.4% stake.

Two senior officials from Macquarie had served on SK shieldus’s board of directors, although they recently resigned as the company prepares for an initial public offering this year. South Korean law mandates that outside directors comprise the majority of the board of a listed company whose assets exceed 2 trillion won.

Apart from SK shieldus, One store, another subsidiary of SK Square, also plans to go public on the Seoul bourse later this year. Macquarie’s bargain hunting of SK Square shares reflects its expectation of an increase in the company’s value following the planned IPOs of the two subsidiaries, industry watchers said.

“Macquarie seems to have faith in the growth prospects of SK Square and also think that its stock is attractive as its subsidiary, SK shieldus, is preparing for an IPO this year,” an industry insider said. (Reporting by Jang-jun Lee)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [i-point]배터리솔루션즈 "IPO 계획 변함없다"

- 다나와 "그래픽카드 거래액 증가…신제품 출시 효과"

- 메리츠증권 PBS 진출 사력…NH증권 키맨 영입 '불발'

- VIP운용 조창현 매니저, '올시즌 2호' 4년만에 내놨다

- [2025 주총 행동주의 리포트]머스트의 조용한 '구조 개입'…침묵이 아닌 설계

- 한국증권, 채권형 중심 가판대 재정비

- 알토스벤처스, 크림 구주 인수 검토…1조보다 낮은 밸류

- 한화증권, 해외 라인업 강화 스탠스 '고수'

- [연금시장에 분 RA 바람]금융사도 일임 경쟁 참전…관건은 은행권 확보

- [택스센터를 움직이는 사람들]"고객만족 최우선시, 시나리오별 절세 노하우 제공"