Korean Air considers options for Asiana Airlines’ low-cost carrier Air Busan stake may be sold internally or externally to comply with fair trade regulations

Translated by Ryu Ho-joung 공개 2021-03-22 08:14:56

이 기사는 2021년 03월 22일 08시01분 thebell에 표출된 기사입니다

Korean Air, part of the Hanjin Group, is considering multiple options for low-cost carriers owned by Asiana Airlines, as the country’s largest airline is outlining plans for post-merger integration with the second largest carrier.Korean Air Wednesday submitted to the state-controlled Korea Development Bank (KDB) its integration plans, which included options for the debt-ridden carrier’s low-cost arm Air Busan, according to industry sources.

In November last year, Hanjin KAL, the holding company of the Hanjin Group, reached an agreement with KDB, the main creditor of Asiana Airlines, to acquire the struggling carrier through Korean Air in the largest deal ever in the country’s aviation industry. At the time, the two parties said the deal was expected to close in the second half of 2021.

There is no change in the timeline, according to sources. But even if the deal is completed as scheduled, the launch of a combined entity of Korean Air and Asiana Airlines will likely take time because of restructuring efforts to streamline redundant operations and overlapped routes.

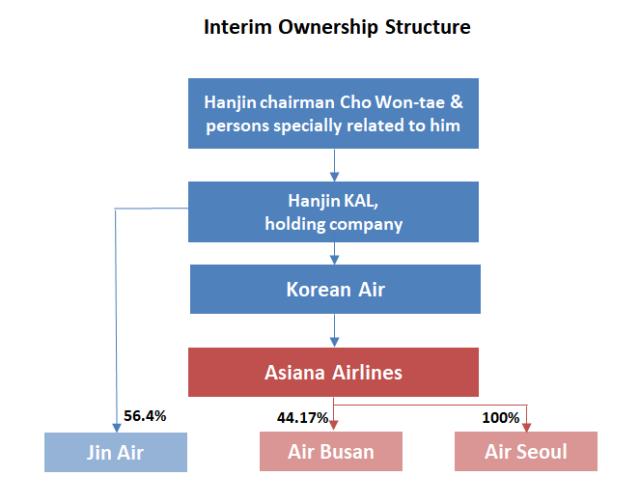

In the interim, Asiana Airlines will remain as a subsidiary of Korean Air, which would make it a second-tier subsidiary of Hanjin KAL. This could pose an issue for the conglomerate’s ownership structure because the country’s fair trade regulations require a holding company’s second-tier subsidiary – i.e. Asiana Airlines in this case – to own 100% of its subsidiaries.

Asiana Airlines has two low-cost arms, Air Seoul and Air Busan. It owns 100% of Air Seoul, while holding only a 44.17% stake in Air Busan.

Observers have been skeptical about the likelihood of Asiana Airlines purchasing the remaining stake in publicly-traded Air Busan, with some expecting that a merger between Air Busan and Jin Air, Korean Air’s low-cost arm, is more likely.

Another option is that Hanjin KAL or Korean Air buys Asiana Airlines’ stake in Air Busan, which would make the low-cost carrier the first or second-tier subsidiary of Hanjin KAL. According to fair trade regulations revised last year, a holding company is required to hold 30% or more of its first and second-tier subsidiaries.

“The situation is up in the air. (Korean Air and KDB) are considering a range of options including a merger or sale,” a person close to the matter said. “If they choose to sell (Asiana Airline’s stake in Air Busan), they could try to find an outside investor or sell it to higher-level companies (within Hanjin’s ownership structure).”

He added: “All options will be discussed based on the key principles, which are to retain jobs and create synergies.”

KDB is expected to review Korean Air’s integration plans over the coming month. Korean Air is said to have frequently communicated with KDB before presenting its plans. The airline is working with law firms including Kim & Chang and Yoon & Yang. (Reporting by Gyoung-tae Kim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

best clicks

최신뉴스 in 전체기사

-

- [i-point]제이엘케이, ‘메디컬 AI 얼라이언스’ 출범식 개최

- 카카오엔터테인먼트 매각, 투자자간 셈법 엇갈린다

- 카카오, '11조 몸값' 카카오엔터테인먼트 매각 추진

- [i-point]대동, 우크라이나 농업부와 미래농업 기술 지원 협력 논의

- '위기를 기회로' 탑코미디어, 숏폼 올라탄다

- [thebell interview]임형철 블로코어 대표 “TGV로 글로벌 AI 투자 확대”

- [VC 경영분석]유안타인베, '티키글로벌' 지분법 손실에 '적자 전환'

- [VC 경영분석]성과보수 늘어난 CJ인베, 줄어드는 관리보수 '과제'

- [VC 경영분석]'첫 성과보수' 하나벤처스, 모든 실적 지표 '경신'

- [VC 경영분석]SBVA, '펀딩·투자·회수' 선순환…'당근' 성과 주목