Share prices gap likely to delay LX’s separation from LG Two chairmen need to swap shares in holding companies but price gap is large

Translated by Ryu Ho-joung 공개 2021-06-04 08:28:23

이 기사는 2021년 06월 04일 07시59분 thebell에 표출된 기사입니다

The separation of a new holding company from LG Group is likely to take longer to be completed due to a significant difference in values of two holding companies.LX Holdings – which was spun off from LG Corp, the holding company of South Korea’s fourth largest conglomerate LG Group – was launched on May 1, with shares of the two holding companies relisted on the local bourse on May 27.

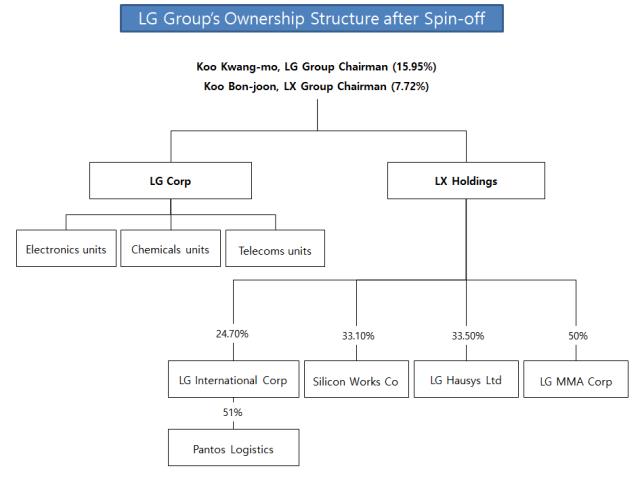

After the spin-off, LX Group chairman Koo Bon-joon holds 7.72% of LG Corp, and LG Group chairman Koo Kwang-mo owns 15.95% stake in LX Holdings. The two members of the founder’s family are expected to swap each other’s shares to separate LX Holdings from LG Group.

Based on Tuesday’s closing prices, Koo Bon-joon’s holding in LG Corp was worth 1.22 trillion won ($1.1 billion), while shares in LX Holdings owned by Koo Kwang-mo were valued at only 130 billion won.

This means a share swap would allow Koo Kwang-mo to unload all of his shares in LX Holdings but would leave Koo Bon-joon to still hold a 6.8% stake in LG Corp worth about 1 trillion won as of Tuesday’s close.

Under the country’s fair trade law, when a conglomerate spins off some of its units, members of the owner’s family cannot cross-hold more than 3% of two listed holding companies. This means LX Holdings can be separated from LG Group only after Koo Bon-joon cuts his stake in LG Corp to less than 3%.

Some expect LX Holdings to remain under LG’s umbrella for some time as the two chairmen are unlikely to rush to exchange each other’s shares amid the recent high volatility in share prices of LG Corp and LX Holdings.

“Shares of the two companies are quite volatile now. The two heads will likely discuss the right timing of a share swap after the share prices of the companies become more stable,” said an industry insider.

Others expect that the two chairmen could exchange each other’s shares soon and then Koo Bon-joon would sell his remaining stake in LG Corp through a block deal, rather than in the open market, to minimize the impact on the share price.

After a share-swap, Koo Bon-joon’s ownership in LX Holdings would increase to more than 20%. He could use the money from a sale of his remaining shares in LG Corp to buy additional shares in LX Holdings to strengthen his control of the holding company.

There is also a possibility that LG Corp could purchase the shares from Koo Bon-joon. Unlike many other holding companies in the country, LG Corp does not hold treasury shares. But chances of that are slim because LG Corp doesn’t need to boost its stock price with the company’s shares at a historic high, industry watchers said.

Treasury shares are often used to defend management rights. But LG Corp has a concentrated ownership structure, with Koo Kwang-mo and his family members together holding a 45.89% stake in the company. (Reporting by Euna Jo)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

best clicks

최신뉴스 in 전체기사

-

- 청약증거금 2조 몰린 쎄크, 공모청약 흥행 '28일 상장'

- [영상/Red&Blue]겹경사 대한항공, 아쉬운 주가

- [i-point]모아라이프플러스, 충북대학교와 공동연구 협약 체결

- [i-point]폴라리스오피스, KT클라우드 ‘AI Foundry' 파트너로 참여

- [i-point]고영, 용인시와 지연역계 진로교육 업무협약

- [i-point]DS단석, 1분기 매출·영업이익 동반 성장

- [피스피스스튜디오 IPO]안정적 지배구조, 공모 부담요소 줄였다

- 한국은행, 관세 전쟁에 손발 묶였다…5월에 쏠리는 눈

- [보험사 CSM 점검]현대해상, 가정 변경 충격 속 뚜렷한 신계약 '질적 성과'

- [8대 카드사 지각변동]신한카드, 굳건한 비카드 강자…롯데·BC 성장세 주목