K Car CEO expects rapid earnings growth to continue in coming years Korean used car retailer saw accelerated growth in operating profit margin in recent years

Translated by Ryu Ho-joung 공개 2021-09-29 08:09:24

이 기사는 2021년 09월 29일 08시08분 thebell에 표출된 기사입니다

Jung In-kook, chief executive of South Korean used car retailer K Car, said that he predicts the growth in the company’s profitability will remain strong in the mid to long-term thanks to economies of scale and robust online sales growth.Jung stressed an upbeat outlook for the company’s profitability during an online press event on Monday ahead of an initial public offering next month. He said that both revenue and operating profit have grown rapidly in recent years, and more importantly, the company has shown a continued improvement in operating profit margin.

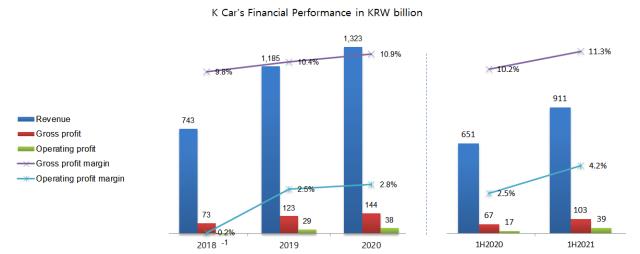

K Car’s revenue has grown at an annual rate of 35.6% in the past two years, from 742.7 billion won in 2018 to 1.12 trillion won in 2019 and 1.32 trillion won in 2020. Revenue growth continued in the first half of 2021, as it reached to 910.6 billion won, up 39.8% year-on-year.

The company swung to an operating profit of 29.2 billion won in 2019 from an operating loss of 1.3 billion won in 2018. The operating profit widened to 37.7 billion won in 2020, and surged 131.8% year-on-year to 38.5 billion won in the first half of this year.

More notable is the accelerated growth in operating profit margin, which rose from negative 0.2% in 2018 to 2.5% in 2019, 2.8% in 2020 and 4.2% in the first half of 2021. A growing operating profit margin means a higher growth in operating profit than revenue.

Growth in the company’s operating profit margin is attributable to an increase in gross profit, calculated by subtracting the cost of goods sold (COGS) from revenue. The company’s gross profit margin steadily rose from 9.8% in 2018 to 10.4% in 2019, 10.9% in 2020 and 11.3% in the first half of 2021.

Solid growth in both revenue and profitability

Jung cited increased revenue from high margin online sales as a reason for the rapid growth in profitability. K Car’s online sales have grown at an annual rate of 63% for the past two years, from 155.7 billion won in 2018 to 408.2 billion won in 2020, much faster than an annual growth rate of 35.6% for the company’s overall revenue. Online sales continued to climb 65.2% year-on-year to 323 billion won in the first half of 2021.

“Gross profit from online sales is roughly 1.61 million won per unit, which is higher than that from offline sales (1.54 million won per unit) because of a fixed-price system and purchases of additional services such as warranties,” Jung said. “Increased contribution to revenue from online sales is the reason for improved profitability.”

Another reason is a reduction in COGS. Used cars, which account for the majority of COGS, are purchased largely through dealer shops and individual car owners. Purchases from dealer shops are more expensive due to brokerage fees.

K Car has purchased more cars from individual owners than through dealer shops in recent years as the company’s scale increases and its customer base expands.

“Direct purchases increased, accounting for 45% of the total in the first half of the year, and the company’s profitability is expected to continue to improve in the coming years driven by operating leverage,” said Jung.

The company’s management expects that revenue will also continue to grow rapidly given the industry’s solid growth prospects.

The domestic used car market is estimated to be worth 39 trillion won. But the market remains fairly fragmented largely due to the government’s policy to protect smaller players. K Car is the largest player in the market with a share of only 3%. Especially, online sales account for a mere 1% of the industry’s overall sales. However, at the same time, there are strong needs for high-quality used car retailers

“The 3% market share represents tremendous growth potential,” Bae Mu-geun, K Car’s chief financial officer said. “Solid growth in revenue and earnings has continued so far in the second half and is expected to continue in the coming years.” (Reporting by Kyung-ju Lee)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- 청약증거금 2조 몰린 쎄크, 공모청약 흥행 '28일 상장'

- [영상/Red&Blue]겹경사 대한항공, 아쉬운 주가

- [i-point]모아라이프플러스, 충북대학교와 공동연구 협약 체결

- [i-point]폴라리스오피스, KT클라우드 ‘AI Foundry' 파트너로 참여

- [i-point]고영, 용인시와 지연역계 진로교육 업무협약

- [i-point]DS단석, 1분기 매출·영업이익 동반 성장

- [피스피스스튜디오 IPO]안정적 지배구조, 공모 부담요소 줄였다

- 한국은행, 관세 전쟁에 손발 묶였다…5월에 쏠리는 눈

- [보험사 CSM 점검]현대해상, 가정 변경 충격 속 뚜렷한 신계약 '질적 성과'

- [8대 카드사 지각변동]신한카드, 굳건한 비카드 강자…롯데·BC 성장세 주목