Posco plans to separate hydrogen and nickel businesses into new subsidiaries Move aimed at turning South Korean steel giant green

Translated by Ryu Ho-joung 공개 2022-01-27 07:58:57

이 기사는 2022년 01월 27일 07시58분 thebell에 표출된 기사입니다

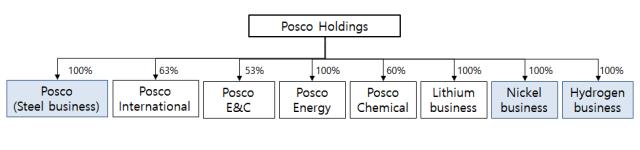

Posco plans to hive off its hydrogen and nickel businesses into new subsidiaries under a holding company structure, as the South Korean steel giant continues its push to turn itself green.“At the moment it is hard to say when (to separate them), rather we need to focus on growing new businesses now,” Kim Hak-dong, Posco’s vice chairman, recently told the bell at an event hosted by the Korea Enterprises Federation, suggesting that establishing those subsidiaries this year is unlikely.

Hydrogen and nickel businesses represent a tiny fraction of Posco’s revenue, with no separate financial details available.

Posco has been stepping up efforts to secure talent that will drive growth of new businesses, with three out of the company’s seven new executives recruited externally late last year being experts in hydrogen technology and secondary battery materials.

By 2030, Posco plans to grow its hydrogen business to a size equivalent to its mainstay steel unit, which accounts for nearly 50% of the company’s total revenue. To that end, the company will invest 10 trillion won ($8.3 billion) to expand its hydrogen production capacity to 500,000 tons per year by 2030.

“Posco will be one of the companies with the greatest hydrogen presence in the future,” Choi Jeong-woo, Posco’s chairman, told the bell at the H2 Mobility+Energy Show held in South Korea last September.

The steel giant also has doubled down on secondary battery materials. In April last year, it invested 150 billion won to establish a wholly owned lithium subsidiary, Posco Lithium Solution, in addition to Posco Argentina S.A.U. which also produces lithium.

Additionally, Posco plans to separate its nickel business to create a new wholly owned subsidiary. This could enable the broader Posco Group to strengthen its competitiveness in the secondary battery materials market as Posco Chemical produces cathode and anode materials whose raw materials include transition metals such as lithium and nickel.

Separating businesses into its new subsidiaries is subject to shareholder approval. In an effort to ease shareholder concerns about a potential decline in the parent company’s value, Posco said, “Even if hydrogen and nickel units are split off in the future, we would not list their shares on the stock market.”

“Fundraising will be led by the holding company and if needed, the holding company will raise additional funds through capital increase, rather than through initial public offerings of new subsidiaries.”

Meanwhile, it is likely that Posco will be able to secure sufficient support at an extraordinary shareholder meeting slated for Friday to shift to a holding company structure and split off its steel business into a wholly owned subsidiary.

The National Pension Service of South Korea, the steel giant’s largest shareholder with a roughly 10% stake, decided earlier this week to support Posco’s proposal.

Global proxy advisory firm Institutional Shareholder Service also recommended shareholders vote for the proposal. Foreign investors hold more than 50% of the company’s shares. (Reporting by Doung Yang)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- 청약증거금 2조 몰린 쎄크, 공모청약 흥행 '28일 상장'

- [영상/Red&Blue]겹경사 대한항공, 아쉬운 주가

- [i-point]모아라이프플러스, 충북대학교와 공동연구 협약 체결

- [i-point]폴라리스오피스, KT클라우드 ‘AI Foundry' 파트너로 참여

- [i-point]고영, 용인시와 지연역계 진로교육 업무협약

- [i-point]DS단석, 1분기 매출·영업이익 동반 성장

- [피스피스스튜디오 IPO]안정적 지배구조, 공모 부담요소 줄였다

- 한국은행, 관세 전쟁에 손발 묶였다…5월에 쏠리는 눈

- [보험사 CSM 점검]현대해상, 가정 변경 충격 속 뚜렷한 신계약 '질적 성과'

- [8대 카드사 지각변동]신한카드, 굳건한 비카드 강자…롯데·BC 성장세 주목