Korean Air taps bond market for $170 mil to refinance debt Improved financial position and appetite for BBB bonds likely to help attract investors

Translated by Ryu Ho-joung 공개 2021-09-27 08:01:11

이 기사는 2021년 09월 27일 07:54 thebell 에 표출된 기사입니다.

Korean Air Lines is once again tapping the corporate bond market next month amid improved prospects for the aviation industry and strong demand for high-yield notes.The South Korean airline will launch the bookbuilding process on October 7 to issue 200 billion won ($170.3 million) in bonds, industry sources said. The issue will consist of two tranches with 2-year and 3-year maturities. Kiwoom Securities, Korea Investment & Securities, Kyobo Securities, Eugene Investment & Securities, DB Financial Investment and IBK Securities are joint bookrunners.

The proceeds from the issuance will be used to refinance the company’s existing debt, with 90 billion won and 100 billion won in debts coming due on November 5 and November 23, respectively.

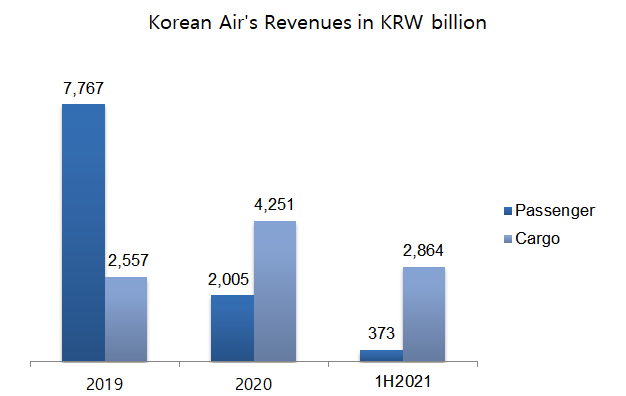

The airline’s passenger traffic is still dramatically below the pre-Covid-19 level, with its passenger revenue standing at 372.6 billion won in the first half of this year, compared with 7.77 trillion won for all of 2019.

In contrast, Korean Air’s cargo revenue grew by 53% year-on-year to a record 2.86 trillion won in the same period, accounting for more than three-quarters of the total consolidated revenue of 3.81 trillion won.

The first-half cargo revenue is even higher than 2.6 trillion won in all of 2019, helping the company navigate through the pandemic and enhancing profitability. Korean Air operates 23 cargo flights to 45 cities across 27 countries to transport various products such as industrial parts, consumer goods, fresh food and medical supplies.

The airline’s total revenue in the first half declined 7% year-on-year, but an operating profit jumped more than tenfold to 295 billion won in the same period. The company also reported a net profit of 60.8 billion won in the first half, compared with 619.5 billion won in net loss in the same period last year.

Industry watchers believe the company’s cumulative operating profit through September will exceed 500 billion won thanks to strong results from cargo operations. Adding to that, Korean Air is expected to see a gradual recovery in its international passenger traffic from 2022, raising hopes that its revenue and earnings will recover to the pre-pandemic level in 2023 or 2024 onwards.

Strong retail demand for BBB-rated bonds

Strong demand for high-yield notes among domestic retail investors, coupled with improved prospects for the company’s earnings, will also likely help attract more investors to the bond offering.

Korean Air is currently rated BBB+ by local credit rating agencies. South Korea’s financial authorities allow fixed-income funds that also invest in initial public offerings to have preferential access to IPO shares if they put at least 45% of their funds into bonds rated BBB+ or lower, or into small-cap Konex-listed stocks. The rule’s sunset date was extended from 2020 to 2023.

This is the reason that bond issues by several BBB-rated issuers, including Doosan Infracore and Hanshin Construction, have all been met with strong demand earlier this year. South Korea’s bond issuance by BBB-rated companies hit a record high in July.

Korean Air is capitalizing on positive sentiment among investors, raising a total of 700 billion won from two bond sales so far this year.

The airline has seen a considerable improvement in its financial position, with net debt of 10.4 trillion won at the end of June this year, down by 4.3 trillion won compared to the end of 2019. An adjusted net debt, which includes hybrid securities and guarantees for the company’s affiliates, also decreased by more than 5 trillion won to 11.3 trillion won in the same period.

Korea Ratings earlier this month revised the rating outlook for Korean Air to Stable. Korea Investors Service and Nice Rating retain its outlook as Negative but removed the company from their negative watch lists last year.

Korean Air may resume investment in aircraft as the airline industry recovers from the pandemic, although any investment will likely be made at a gradual pace. The company also already made a 1 trillion won payment for its 1.8 trillion won takeover of Asiana Airlines.

There are little concerns about the company’s liquidity as well. Korean Air last year secured more than 2 trillion won through a rights issue and the sales of non-core assets, and also raised 3.3 trillion won through another rights issue earlier this year. Additional sales of non-core assets are also expected to be completed before the end of the year. (Reporting by Chan-mi Oh)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [북미 질주하는 현대차]윤승규 기아 부사장 "IRA 폐지, 아직 장담 어렵다"

- [북미 질주하는 현대차]셀카와 주먹인사로 화답, 현대차 첫 외국인 CEO 무뇨스

- [북미 질주하는 현대차]무뇨스 현대차 사장 "미국 투자, 정책 변화 상관없이 지속"

- 수은 공급망 펀드 출자사업 'IMM·한투·코스톤·파라투스' 선정

- 마크 로완 아폴로 회장 "제조업 르네상스 도래, 사모 크레딧 성장 지속"

- [IR Briefing]벡트, 2030년 5000억 매출 목표

- [i-point]'기술 드라이브' 신성이엔지, 올해 특허 취득 11건

- "최고가 거래 싹쓸이, 트로피에셋 자문 역량 '압도적'"

- KCGI대체운용, 투자운용4본부 신설…사세 확장

- 이지스운용, 상장리츠 투자 '그린ON1호' 조성