HMM may bid for Hyundai LNG Shipping Potential acquisition likely to help shipping company diversify portfolio and find buyer

Translated by Ryu Ho-joung 공개 2021-08-19 08:04:06

이 기사는 2021년 08월 19일 08시02분 thebell에 표출된 기사입니다

HMM may bid for Hyundai LNG Shipping, formerly HMM’s liquid natural gas operations, seven years after the shipping company reluctantly offloaded the business to private equity investors.IMM Private Equity and IMM Investment recently decided to exit their investment in Hyundai LNG Shipping and have been sounding out potential buyers, according to industry sources. They bought the business from HMM, formerly known as Hyundai Merchant Marine, in 2014 for 1.03 trillion won ($881.4 million).

As Hyundai LNG Shipping has been put up for sale, HMM is being mentioned as the most likely potential buyer. The sale of its LNG unit was a reluctant decision by HMM as part of a restructuring plan announced in 2013 by the then cash-strapped Hyundai Group.

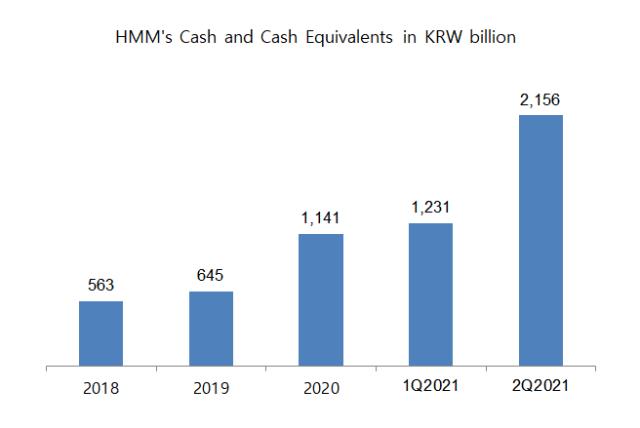

HMM’s strong cash position also reinforces the possibility of the company bidding for Hyundai LNG Shipping. At the end of June, HMM had cash and cash equivalents of 2.16 trillion won, up by nearly 1 trillion won compared to three months ago.

“Nothing has been finalized,” said an official at HMM. But many believe the company has studied a possible bid, though there is no guarantee an offer will materialize.

HMM’s potential acquisition of Hyundai LNG Shipping will help the company diversify its portfolio beyond container shipping. Its container business accounts for about 93% of total revenues, increasing from 79% in 2015.

Hyundai LNG Shipping could be an attractive target for acquisition as HMM looks to reduce its reliance on container shipping and expand its portfolio again to bulk cargo. HMM intends to expand the operation of bulk cargo vessels, from 63 at the end of June to about 100.

Hyundai LNG Shipping has generated stable earnings and cash flow based on long-term contracts with the country’s gas corporations. Its annual revenue was around 200 billion won in recent years.

HMM is considered a candidate for sale as the company is currently controlled by creditors led by Korea Development Bank (KDB). Business diversification achieved by a potential takeover of Hyundai LNG Shipping may help increase HMM’s attractiveness for potential buyers.

However, Hyundai LNG Shipping’s price tag is as high as 2 trillion won, twice the price HMM was paid seven years ago.

In addition, any attempt to make an acquisition by HMM requires consent of creditors including KDB and Korea Ocean Business Corporation.

“Even if HMM is interested in acquiring Hyundai LNG Shipping, it would not be easy to receive consent from creditors,” said an official at one shipping company. (Reporting by Su-jin Yoo)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [건설리포트]동문건설, 수주목표 '1.2조' 실적 반등 나선다

- GS건설, 허진홍 상무 필두 '디벨로퍼 사업' 확대

- 이월드 품은 이랜드월드, 손상차손 '400억' 반영

- 포스코이앤씨, 1300억 사채 차환…금리 3%대 도전장

- [건설사 추정 수익·원가 분석]현대건설, 발주처 증액 협상 난이도 높아졌다

- [이사회 분석/호텔롯데]이사회 전면 재편, 글로벌 공략 방점

- [건설사 PF 포트폴리오 점검]호반건설, 우발부채 1조 규모로 늘어난 까닭은

- 대신자산신탁, 안동 차입형 사업지 계정대 '유동화'

- HMG, 여의도 4000억 부지 매입 검토

- [경동나비엔은 지금]변화의 바람, 리더십 교체·사업 다각화 동시다발 개편