Teachers’ Pension on track for double-digit return on alternative investments this year Korea’s $19 billion pension fund benefits from investments in JobKorea and HYBE

Translated by Ryu Ho-joung 공개 2021-10-21 08:06:49

이 기사는 2021년 10월 21일 08시04분 thebell에 표출된 기사입니다

Teachers’ Pension is on track to earn a double-digit return on alternative assets after it posted over an 8% return from the asset classes so far this year thanks to bumper gains from its investments in JobKorea and HYBE.The South Korean pension fund said on Tuesday that its alternative investment portfolio returned 8.53% in the first nine months of 2021, up more than 3 percentage points from a 5.04% return for 2020. The return is equivalent to a 1.78 trillion won ($1.5 billion) gain in the same period, or an annualized gain of 2.37 trillion won, compared to 2.14 trillion won for 2020.

Teachers’ Pension has continued to grow in assets under management for the past years, with its AUM surpassing 10 trillion won in 2012 and 20 trillion won in 2020. It had 22.72 trillion won under management at the end of September this year, up 8.66% from 20.91 trillion won at the end of 2020.

The fund’s handsome return was partly driven by successful exits from online recruitment platform JobKorea and HYBE, the entertainment company behind K-pop phenomenon BTS.

Teachers’ Pension in 2013 put 70 billion won into private equity firm H&Q’s 506.5 billion won third fund, which was used to invest in JobKorea. Other South Korean limited partners in the fund included the National Pension Service, as the fund’s anchor investor with its capital commitment of 280 billion won, and Korean Teachers' Credit Union, which committed 100 billion won.

H&Q spent 114.5 billion won on the purchase of a 100% stake in JobKorea over the two years from 2013. The online recruitment company was sold to Affinity Equity Partners in May this year for approximately 900 billion won, giving H&Q a return of 7.8 times invested capital.

Teachers’ Pension also invested in STIC Investments’ first special situations fund, which closed at 603.2 billion won in 2016. STIC acquired a minority stake worth 104 billion won in HYBE, formerly known as Big Hit Entertainment, via the fund in October 2018, and sold its stake through a block deal in June this year. The exit reportedly produced over an 800 billion won gain and a 137% internal rate of return.

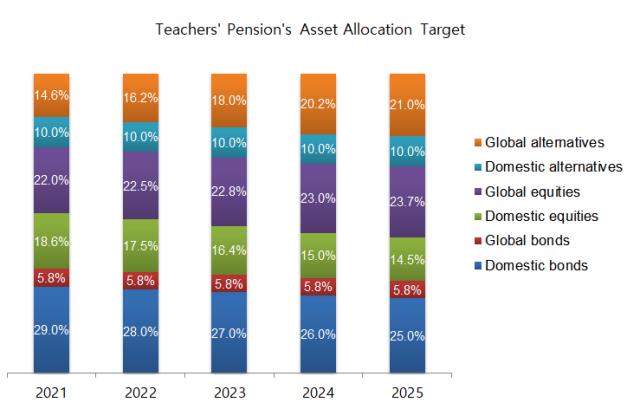

The pension fund intends to gradually increase its allocation to alternative investments from the current 24% to more than 30% by 2025. (Reporting by Ha-na Suh)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- 청약증거금 2조 몰린 쎄크, 공모청약 흥행 '28일 상장'

- [영상/Red&Blue]겹경사 대한항공, 아쉬운 주가

- [i-point]모아라이프플러스, 충북대학교와 공동연구 협약 체결

- [i-point]폴라리스오피스, KT클라우드 ‘AI Foundry' 파트너로 참여

- [i-point]고영, 용인시와 지연역계 진로교육 업무협약

- [i-point]DS단석, 1분기 매출·영업이익 동반 성장

- [피스피스스튜디오 IPO]안정적 지배구조, 공모 부담요소 줄였다

- 한국은행, 관세 전쟁에 손발 묶였다…5월에 쏠리는 눈

- [보험사 CSM 점검]현대해상, 가정 변경 충격 속 뚜렷한 신계약 '질적 성과'

- [8대 카드사 지각변동]신한카드, 굳건한 비카드 강자…롯데·BC 성장세 주목