Posco reports record earnings before shift to holding company Korean steel giant records $7.6 bil in operating profit on revenue of $63 bil in 2021

Translated by Ryu Ho-joung 공개 2022-02-04 07:50:50

이 기사는 2022년 02월 04일 07시48분 thebell에 표출된 기사입니다

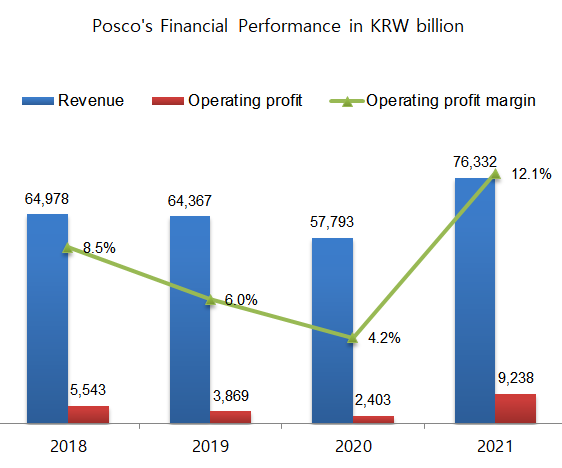

South Korean steel giant Posco reported record earnings in 2021, the last year before transitioning to a holding company structure.Posco said in an investor call on January 28 that it recorded 9.2 trillion won ($7.6 billion) in operating profit on revenue of 76.4 trillion won for 2021 on a consolidated basis, up 32% year-on-year and the strongest annual results in its 53-year history.

Earlier that day, the company’s plan to shift to a holding company system was approved at its extraordinary shareholders meeting. As a result, Posco will be separated into two entities in March: Posco Holdings, the group’s holding company, and the steel business unit Posco, which will be wholly owned by Posco Holdings.

At the group level, the steel business generated revenue of 63.5 trillion won last year, up nearly 46% from a year ago. Given intercompany transactions worth roughly 15 trillion won in 2020, the new steel subsidiary is likely to generate around 49 trillion won in annual revenue after the split-off.

Robust revenue growth was largely driven by strong demand for steel as the global economy recovers from the Covid-19 pandemic, leading to an increase in sales of the steelmaker’s high-margin products.

Posco’s operating profit also nearly quadrupled from a year ago, with price increases on its products offsetting the impact of higher raw materials costs.

Posco said it expects steel demand to grow more than 2% in 2022, with growth slowing in the second half of the year. However, an increase in steel supply is likely to be limited in the short term amid the transition to low carbon emissions, the company said.

Posco Holdings’ future annual revenue is estimated to be around 27 trillion won, which roughly equals to the company’s 2021 consolidated revenue less the revenue from the steel business.

The holding company will focus on new businesses for future growth, such as secondary battery materials and hydrogen energy.

In its push to expand the secondary battery materials business, Posco Holdings plans to increase production capacity of anodes and cathodes and build plants to produce lithium and nickel while expanding its recycling business.

Posco Holdings also intends to double down on hydrogen production. “We will invest to build clean hydrogen plants overseas and secure key technologies,” the company’s official said.

“We will also hire more experts externally in areas like secondary battery materials, clean hydrogen energy and artificial intelligence.” (Reporting by Seo-young Kim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- 청약증거금 2조 몰린 쎄크, 공모청약 흥행 '28일 상장'

- [영상/Red&Blue]겹경사 대한항공, 아쉬운 주가

- [i-point]모아라이프플러스, 충북대학교와 공동연구 협약 체결

- [i-point]폴라리스오피스, KT클라우드 ‘AI Foundry' 파트너로 참여

- [i-point]고영, 용인시와 지연역계 진로교육 업무협약

- [i-point]DS단석, 1분기 매출·영업이익 동반 성장

- [피스피스스튜디오 IPO]안정적 지배구조, 공모 부담요소 줄였다

- 한국은행, 관세 전쟁에 손발 묶였다…5월에 쏠리는 눈

- [보험사 CSM 점검]현대해상, 가정 변경 충격 속 뚜렷한 신계약 '질적 성과'

- [8대 카드사 지각변동]신한카드, 굳건한 비카드 강자…롯데·BC 성장세 주목