Yeochun NCC plant explosion leads to bond sale fiasco Korean chemical company gets no bid for its bond offering on Monday

Translated by Ryu Ho-joung 공개 2022-02-16 08:10:50

이 기사는 2022년 02월 16일 08:09 thebell 에 표출된 기사입니다.

Yeochun NCC, a South Korean chemical company, shockingly received a zero bid for its bond offering on Monday as the company’s reputational risk is highlighted in the market by a deadly blast at its Yeosu plant.The company had planned to issue 200 billion won ($166.7 million) in bonds with 3-year and 5-year maturities. Initial price guidance was -30 to +30 basis points versus the average yield for the 3-year bond and -30 to +50 basis points versus the average yield for the 5-year bond.

The offering is underwritten by three brokerage firms KB Securities, NH Investment & Securities and Korea Investment & Securities.

The bond offering attracted little interest from investors, ultimately getting no bid during the book building on Monday.

This fiasco was due to an explosion at the company’s plant in Yeosu, South Jeolla Province, on Friday morning, which killed four people and injured four others. Shortly after the accident, labor ministry officers and police raided the plant’s on-site office and the company’s two vendors to find evidence of whether there was any violation of safety and health rules.

If any violation charges are proved, Yeochun NCC would be the country’s first petrochemical company penalized under the Severe Disasters Punishment Act, which went to effect in January.

The new law imposes at least one year of imprisonment or up to 1 billion won in fine on a company’s owner or chief executive who violates safety and health regulations, and up to 5 billion won in fine on a business entity.

It is likely that the explosion and the police investigation of Yeochun NCC will significantly impair the company's ability to raise capital, as South Korean investors increasingly integrate environmental, social and governance (ESG) factors alongside traditional financial data into their investment selection process.

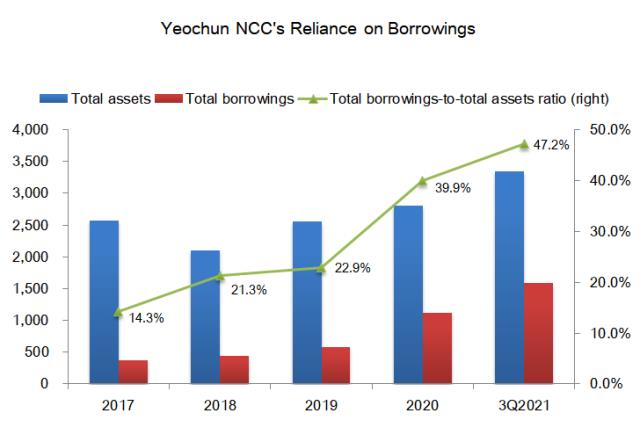

Yeochun NCC, jointly owned by Hanwha Solutions and DL Chemical, heavily relies on external debt, with total borrowings of 1.58 trillion won and the total borrowings-to-total assets ratio of 47.2% at the end of September 2021. The company’s outstanding corporate bonds stood at 890 billion won as of February 10, 2021, according to a filing for its latest bond offering.

“It’s an embarrassing result,” an official at Yeochun NCC said. “We are considering options including extending the subscription period to attract orders.” (Reporting by Joon-woo Nam)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- 수은 공급망 펀드 출자사업 'IMM·한투·코스톤·파라투스' 선정

- 마크 로완 아폴로 회장 "제조업 르네상스 도래, 사모 크레딧 성장 지속"

- [IR Briefing]벡트, 2030년 5000억 매출 목표

- [i-point]'기술 드라이브' 신성이엔지, 올해 특허 취득 11건

- "최고가 거래 싹쓸이, 트로피에셋 자문 역량 '압도적'"

- KCGI대체운용, 투자운용4본부 신설…사세 확장

- 이지스운용, 상장리츠 투자 '그린ON1호' 조성

- 아이온운용, 부동산팀 구성…다각화 나선다

- 메리츠대체운용, 시흥2지구 개발 PF 펀드 '속전속결'

- 삼성SDS 급반등 두각…피어그룹 부담 완화