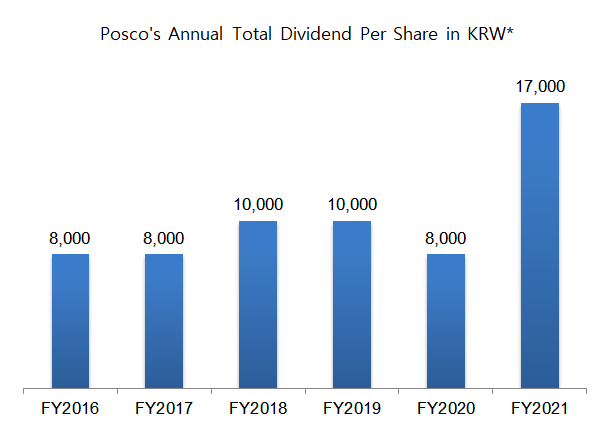

Posco pays highest dividend ever ahead of shift to holding company Korean Steel giant’s annual total dividend per share doubles to $14.18 for 2021

Translated by Ryu Ho-joung 공개 2022-02-08 08:11:48

이 기사는 2022년 02월 08일 08시11분 thebell에 표출된 기사입니다

Posco has declared the highest-ever total dividend per share for last year ahead of its transition to a holding company structure in March, a move seemingly aimed at reaffirming its commitment to shareholder returns.On January 28, the South Korean steel giant’s board of directors voted to pay a final dividend of 5,000 won ($4.17) per share for fiscal year 2021, bringing the total annual dividend per share to 17,000 won, more than a twofold increase from 8,000 won in 2020 and the highest in the company’s history.

The robust growth in its dividend payout followed record financial results, with Posco’s operating profit increasing 485% year-on-year to 6.65 trillion won in 2021 on a non-consolidated basis. Net profit also jumped 436% to 5.18 trillion won.

Apart from that, the company’s decision to raise dividend is apparently to do with its shift to a holding company system.

On the day when a final dividend was declared, Posco’s shareholders approved a plan to split off its mainstay steel business into a separate unlisted entity that will be wholly owned by a new holding company named Posco Holdings.

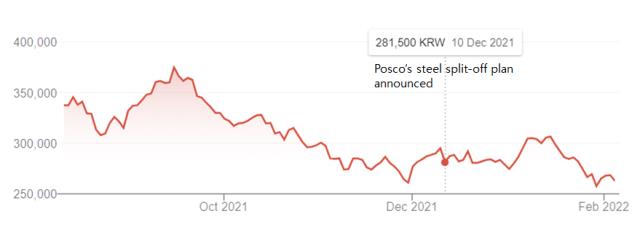

The plan initially faced shareholder concerns as other South Korean companies that took a similar path – including LG Chem, which split off its electric vehicle battery unit in December 2020 – opted to list their newly created subsidiaries, resulting in a slide in the price of the parent companies’ stocks. This added volatility to Posco’s share price in recent months.

In an effort to reassure shareholders, Posco made it clear that it would not list the steel unit without approval from the holding company’s shareholders by adding such provisions to the subsidiary’s articles of association. It also pledged to increase shareholder returns in future years.

The highest-ever dividend payout by the company is seen as a move to reward shareholders for their confidence in Posco, and to quash doubts about the impact of its transition to a holding company on shareholder value creation, industry watchers said.

“Posco’s total dividend per share of 17,000 won for 2021 demonstrates its strong commitment to shareholder returns, which is an important factor in predicting its share price in the future,” a market insider said.

“A dividend yield as high as in excess of 6% and the planned retirement of treasury shares will help Posco shares remain more resilient to downside risk.”

Posco previously announced that it would retire part of its roughly 11.6 million treasury shares later this year. It also plans to continue to pay a total annual dividend per share of 10,000 won or more in the mid to long term. (Reporting by Doung Yang)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- 청약증거금 2조 몰린 쎄크, 공모청약 흥행 '28일 상장'

- [영상/Red&Blue]겹경사 대한항공, 아쉬운 주가

- [i-point]모아라이프플러스, 충북대학교와 공동연구 협약 체결

- [i-point]폴라리스오피스, KT클라우드 ‘AI Foundry' 파트너로 참여

- [i-point]고영, 용인시와 지연역계 진로교육 업무협약

- [i-point]DS단석, 1분기 매출·영업이익 동반 성장

- [피스피스스튜디오 IPO]안정적 지배구조, 공모 부담요소 줄였다

- 한국은행, 관세 전쟁에 손발 묶였다…5월에 쏠리는 눈

- [보험사 CSM 점검]현대해상, 가정 변경 충격 속 뚜렷한 신계약 '질적 성과'

- [8대 카드사 지각변동]신한카드, 굳건한 비카드 강자…롯데·BC 성장세 주목